The number of Americans filing new claims for unemployment benefits held below pre-pandemic levels last week, while consumer spending increased solidly, putting the economy on track for a strong finish to 2021.

But price pressures continued to build up, with a measure of underlying inflation recording its largest annual increase since 1989 in November. The reports on Thursday came as the nation was struggling with a resurgence in COVID-19 infections, driven by the Delta and highly transmissible Omicron variant, which could crimp economic growth in the first quarter.

"Rising virus cases are a near term risk but overall, we expect growth to pick up in the fourth quarter from a subdued pace in the third quarter," said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York.

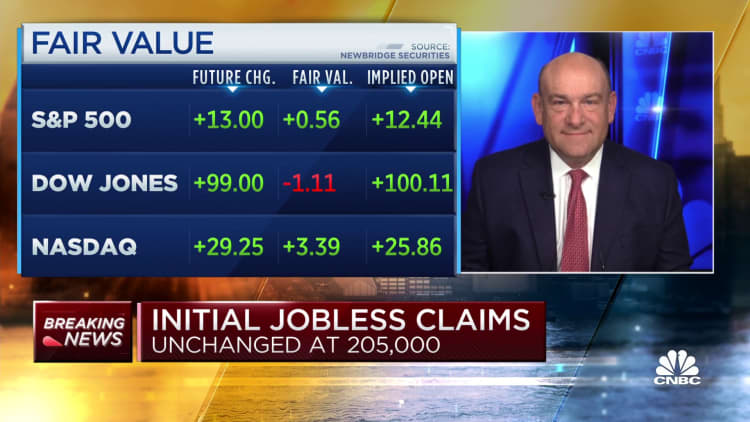

Initial claims for state unemployment benefits were unchanged at a seasonally adjusted 205,000 for the week ended Dec. 18, the Labor Department said. Early this month, claims dropped to a level last seen in 1969.

Economists polled by Reuters had forecast 205,000 applications for the latest week. Claims have declined from a record high of 6.149 million in early April of 2020.

Applications typically increase during the cold weather months, but an acute shortage of workers has disrupted that seasonal pattern, resulting in lower seasonally adjusted claims numbers in recent weeks.

There were sharp declines in unadjusted claims in Missouri and Pennsylvania, which offset an increase in California.

"Looking past that noise, however, we expect claims to remain around 200,000 as layoffs remain low amid tight labor market conditions," said Nancy Vanden Houten, lead U.S. economist at Oxford Economics in New York.

"The spread of the Omicron variant may lend an upside risk to that forecast, but for now, it appears as though businesses are striving to remain open."

The claims data covered the period during which the government surveyed businesses for the nonfarm payrolls portion of December's employment report.

Claims dropped between the November and December survey periods, suggesting a pickup in job growth this month. Labor shortages, however, remain a challenge. There are hopeful signs that unemployed Americans are starting to return to the labor force, but soaring coronavirus infections could be an obstacle.

The number of people continuing to receive benefits after an initial week of aid fell 8,000 to 1.859 million in the week ended Dec. 11. That was the lowest level for the so-called continuing claims since mid-March of 2020.

Services buoy spending

The labor market is tightening, with the unemployment rate at a 21-month low 4.2%. There were a record 11.0 million job openings at the end of October.

Higher wages as companies scramble for scarce workers are helping to underpin consumer spending.

A separate report from the Commerce Department on Thursday showed consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose 0.6% last month. Consumer spending shot up 1.4% in October.

Services surged 0.9%, accounting for nearly all the gain in spending last month. The broad increase in services was led by housing and utilities.

Spending on goods edged up 0.1% as outlays on long-lasting manufactured goods like motor vehicles fell 0.6% reflecting shortages. Spending on goods was also weaker after Americans started their holiday shopping early to avoid empty shelves.

The scarcity of goods is hampering business spending on equipment. A third report from the Commerce Department showed orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, dipped 0.1% last month. These so-called core capital goods orders jumped 0.9% in October.

Inflation accelerated in November. The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, rose 0.5% after a similar gain in October.

In the 12 months through November, the so-called core PCE price index accelerated 4.7%. That was the largest increase since February 1989 and followed a 4.2% year-on-year advance in October.

When adjusted for inflation, consumer spending was flat after increasing 0.7% in October. Despite the unchanged so-called real consumer spending last month, economic growth is expected to have accelerated in the fourth quarter.

Growth forecasts for the fourth quarter are as high as a 7.2% annualized rate. The economy grew at a 2.3% pace in the third quarter. It is expected to grow 5.6% this year, which would be the fastest since 1984, according to a Reuters survey of economists. The economy contracted 3.4% in 2020.

But the outlook for next year is cloudy. COVID-19 infections are soaring and President Joe Biden's signature $1.75 trillion domestic investment bill known as Build Back Better, which aims to expand the social safety net and tackle climate change, suffered a blow on Sunday when moderate Democrat Senator Joe Manchin said he would not support it. That prompted economists to slash their growth estimates for next year.