CNBC's Jim Cramer on Thursday said that investors looking to successfully navigate a market roiled by inflation, geopolitical concerns and Covid should do two things: buy discriminately and be inquisitive.

"It's hard to be curious. … But over the long-haul, curiosity tends to be a much better bet [than panic]. Right now, I think a curious mind would be buying stocks selectively, not selling them indiscriminately," the "Mad Money" host said.

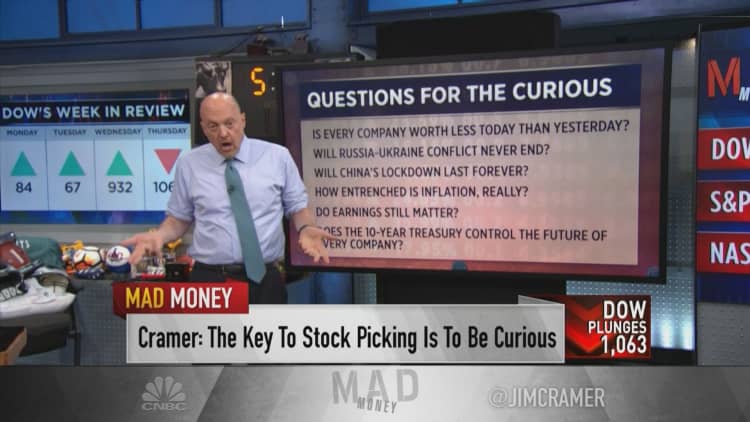

The Dow Jones Industrial Average tumbled 3.12% on Thursday while the Nasdaq Composite plummeted 4.99%, with both drops marking the worst losses in a single day since 2020. The S&P 500 slipped 3.56%, recording its second-to-worst day in 2022.

The market's dismal performance comes a day after the Federal Reserve raised interest rates by 50 basis points and said it will begin tightening its balance sheet in June.

"Right now, I think the market's anticipating the worst-case scenario and there's a good chance that we actually don't get it," Cramer said of the Fed's inflation-fighting measures.

He added that curious investors should ask themselves several questions to gauge the state and future of the market. Here are some of the notable questions Cramer outlined:

- Is every company worth less today than yesterday, when the stock market rallied? Cramer said the answer is no. "If you take your cue only from the bond market, we're headed for a high-inflation world where the Fed has to raise rates aggressively. That means you should buy stocks that do well … in a high-inflation slowdown," he said.

- Will the Russia-Ukraine war or China's lockdowns last forever? Cramer reminded investors that this is not the case, and predicted that Nike and Starbucks could see huge snapback rallies once lockdowns in China end.

- Is inflation really that deeply entrenched in the market? "When only oil and natural gas continue to hit new highs, maybe this inflation's easier to beat than most people expect," Cramer said.

- Do a company's earnings still matter? Yes they do, Cramer said, adding that AMD's stock is a buy, even at its low levels.

He also said that now might be a great buying opportunity for investors who have money on hand and are looking for additions to their portfolios.

"If you've got enough cash on the sidelines, the market's throwing a sale on everything, including some great stocks with good yields that have great prospects that are going to beat the earnings," he said.

Disclosure: Cramer's Charitable Trust owns shares of AMD.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com