Dick's Sporting Goods said Wednesday it's trimming its financial outlook for the year amid uncertain economic conditions, but that it isn't yet seeing any dramatic shifts in its business.

On a call with analysts, Chief Executive Officer Lauren Hobart said she had confidence in Dick's longer-term business strategy and in maintaining profitability. The company's stock rallied after a stark sell-off in shares in early trading, when they sank to a fresh 52-week low of $63.45.

Dick's shares closed the day up nearly 10%.

Despite the challenging economic backdrop, Hobart said the company has several advantages buoying its business. Its private-label brands have gained traction with customers. She said pressure to mark down excess items remains low. And consumers have embraced outdoor hobbies such as hiking and golfing during the Covid pandemic.

"They are running. They are walking, they're playing golf," Hobart said. "The pandemic surging categories that we've all been talking about ... we believe they all have long-term growth potential."

Still, 40-year-high inflation and ongoing supply chain challenges were enough for Dick's to issue what it said was a "cautious" outlook for the year.

Dick's now expects to earn between $9.15 and $11.70 per share, on an adjusted basis, this fiscal year, compared with a prior range of $11.70 to $13.10. Analysts had been looking for adjusted earnings per share of $12.56, according to Refinitiv estimates.

Dick's is forecasting same-store sales to be down 2% to 8%, versus prior expectations for sales to be flat to down 4%. Analysts were calling for a year-over-year decline of 2.5%, according to FactSet.

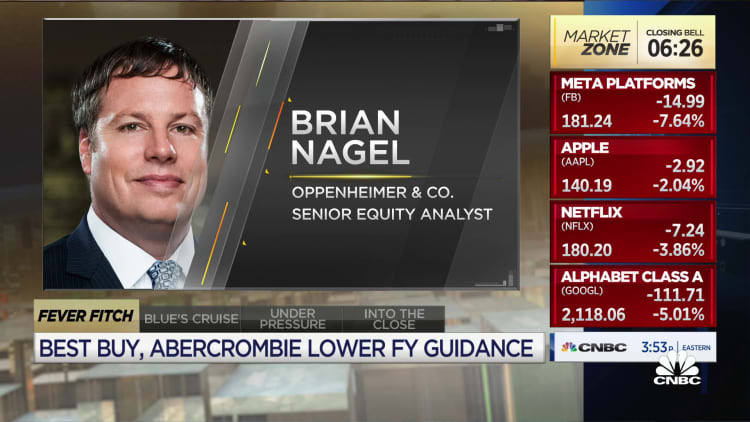

The company's decision to lower its guidance comes after similar adjustments from Walmart, Target and Kohl's, as these retailers cope with higher expenses that are eating into their earnings. Shares of apparel retailer Abercrombie & Fitch fell nearly 30% Tuesday after the company slashed its outlook for the year.

Here's how Dick's did in its fiscal first quarter compared with what Wall Street was anticipating, using Refinitiv estimates:

- Earnings per share: $2.85 adjusted vs. $2.48 expected

- Revenue: $2.7 billion vs. $2.59 billion expected

Dick's reported net income for the three-month period ended April 30 of $260.6 million, or $2.47 per share, compared with net income of $361.8 million, or $3.41 a share, a year earlier. Excluding one-time items, the company earned $2.85 per share.

Sales fell about 8% to $2.7 billion from $2.92 billion a year earlier, but they were enough to top expectations.

Dick's said its loyalty members accounted for more than 70% of sales. Its stores fulfilled over 90% of transactions, including online purchases, as Dick's made the most of inventory sitting in stock rooms.

The company reported inventory levels as of April 30 up 40.4% from a year earlier. But Chief Financial Officer Navdeep Gupta said Dick's is closely controlling inventory levels, so the retailer won't end up with excess merchandise and have to slash prices later in the year.

"We believe our inventory at plus 40% actually is very healthy, and we are very pleased with it," Hobart said.

Dick's also touted its strong relationships with national brands, including Nike, at a time when some of these labels have been pulling out of third-party channels to focus on selling directly to customers. Hobart said it's a testament to the company's investments in its stores and the customer shopping experience.

Telsey Advisory Group analyst Joe Feldman said Dick's will continue to be a long-term market share gainer, thanks in large part to its mix of both national brands and in-house lines. Its off-mall locations are also more appealing to customers today, he said.

Dick's shares have fallen about 32% year to date, inclusive of Wednesday's gains.

— CNBC's Melissa Repko contributed to this reporting.