Silicon Valley Bank's collapse was due to poor communication that it was getting killed on its bond portfolio because the Fed raised interest rates so rapidly, CNBC's Jim Cramer said Friday.

It's a "Cool Hand Luke" problem, Cramer said, a classic case of a failure to communicate. SVB's bond portfolio lost tremendous value because the Fed raised interest rates so rapidly, but the bank failed to communicate that to investors. At the same time, SVB's failure to signal how many startup-equity backed loans it had distressed investors.

"...there's no appetite for IPOs when the Fed's tightening aggressively," Cramer said.

But in short, Cramer said, the bank was hit hard by the Federal Reserve's rate hikes. It was a collapse that didn't need to happen, Cramer continued.

After all, the Mad Money host argued, nothing is more deflationary than the collapse of a debt-burdened bank.

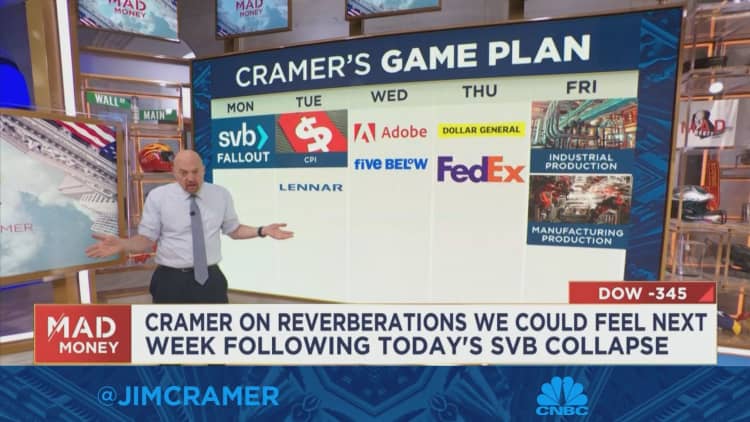

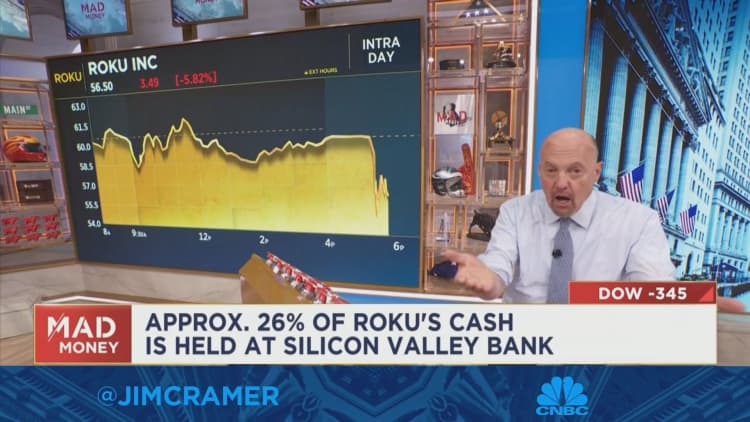

The knock-on effect for the "growth economy," or startups and the venture capital firms that fuel them, is real, Cramer said. But it will also stay the Fed's hand, Cramer argued, lest more banks collapse due to "a failure to communicate."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com