Key Points

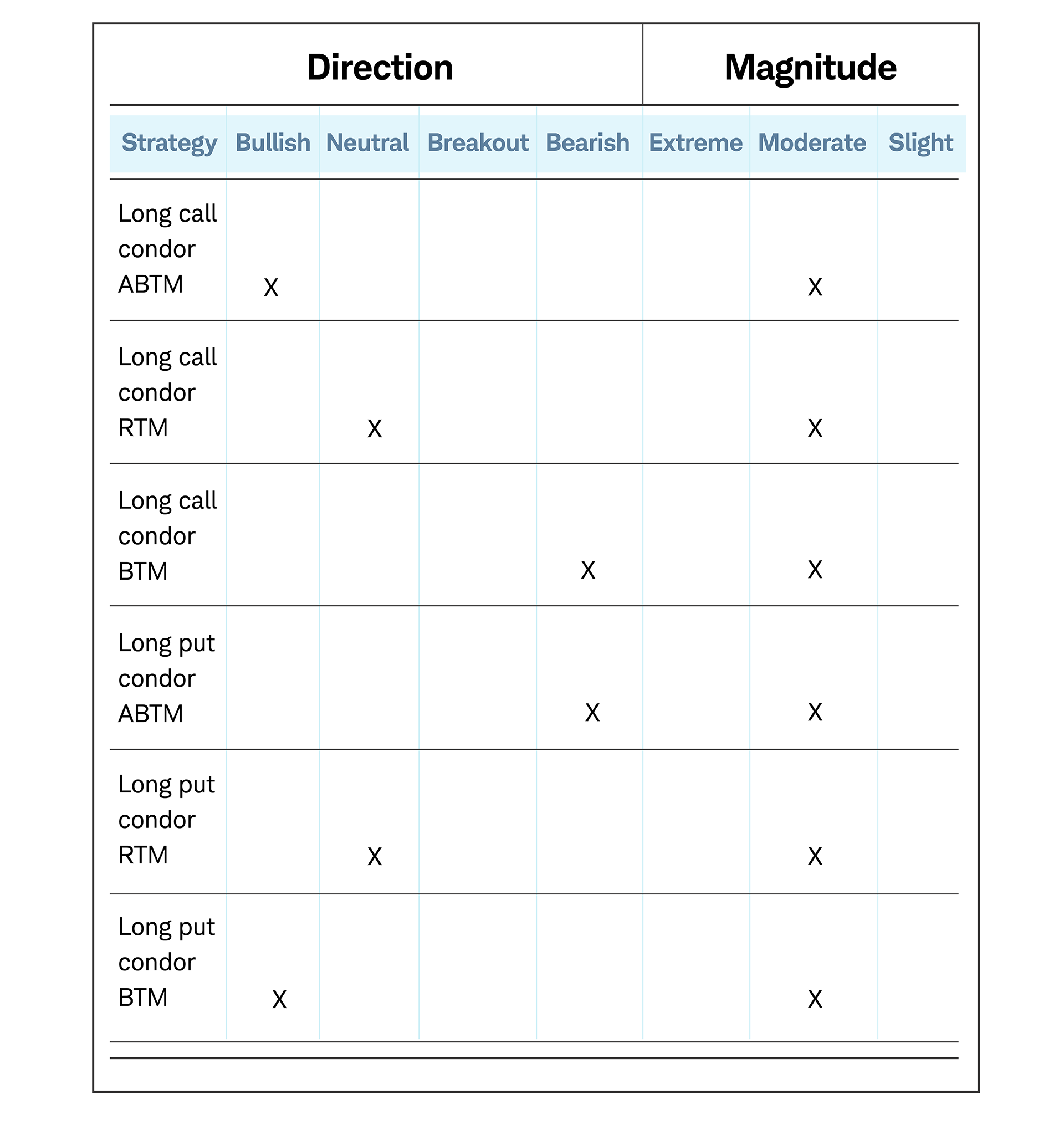

- A long condor spread is a neutral strategy that can be used when the underlying stock or ETF is trading in a narrow range and you expect little movement in the underlying stock, index or exchange traded product (ETP) .

- It includes four different strike prices with the same expiration month and the following format: Buy one option (at the lowest strike price), sell one option (at the next higher strike price), sell one option (at the next higher strike price) and buy one option (at the highest strike price).

- Long condors differ from long butterflies in that you can achieve maximum profitability over a range of prices, rather than a single price point. The trade-off is a lower potential reward.

- We explore how to create and how to give a bullish or bearish tilt to long condors.

A long condor is the most common of the four-legged option strategies. It is a mostly neutral strategy that can be used when the underlying stock or ETF is trading in a narrow range.

A condor spread is always established with the exact same quantity of contracts on all four legs and it can be composed of either calls or puts.

Typically, the underlying stock will be halfway between the two middle strike prices when you set up the strategy. To visualize it, think of it as a butterfly that has been extended with four strike prices.

How does it differ from a butterfly?

A condor is often compared to the more well-known three-legged butterfly strategy. Like the butterfly, its maximum gain, maximum loss and breakeven points are all known at the point of order entry. However, the condor differs from the butterfly's single price point for maximum gain, as its structure allows for a maximum gain to occur over a range of prices.

With this structure, it essentially allows more room for error when trying to achieve maximum profitability. The give-up, however, is that the maximum gain potential is less, and the maximum loss potential is greater than a similarly structured butterfly.

While still less popular than the butterfly, retail interest for this strategy has grown as option commissions have declined. With the introduction of multi-leg option order-entry screens, at Schwab you actually get a discount on commissions when you enter multi-legged strategies such as spreads, straddles, butterflies, condors, etc., as a single order, rather than as multiple smaller orders.

When to enter a trade

The ideal time to enter a condor spread is when you expect little movement in the underlying instrument (stock or ETF) and it's trading between the two middle strike prices. When you believe a stock will remain very stable, a butterfly may be your best strategy, but when you are more uncertain, the condor is probably a better choice.

Let's take a look at a sample condor trade.

Purpose: limited risk with limited profit potential

Long condor spread:

Buy to open 10 XYZ Feb 55 Calls @ 6.00A

Sell to open 10 XYZ Feb 60 Calls @ 1.50B

Sell to open 10 XYZ Feb 65 Calls @ .50B

Buy to open 10 XYZ Feb 70 Calls @ .10A

When you initiate an order like this, using the All in One trade ticket (inspired by optionsXpress), StreetSmart Edge® will automatically calculate the market price of this 10/10/10/10 spread. To manually calculate it, reduce the spread by its greatest common factor of 10 to 1/1/1/1 and then multiply each leg by the market price, using the ask price on the legs you are buying, and the bid price on the legs you are selling:

1 X -6A = -6.00

1 X +1.50B = +1.50

1 X +.50B = +.50

1 X -.10A = -.10

Net = -4.10 x 10 spreads = ($4,100) total up front cost

The condor spread's market price is a debit of 4.10, and its total cost would be 4.10 x the number of 1/1/1/1 spreads (10) x the option multiplier (100) = ($4,100).

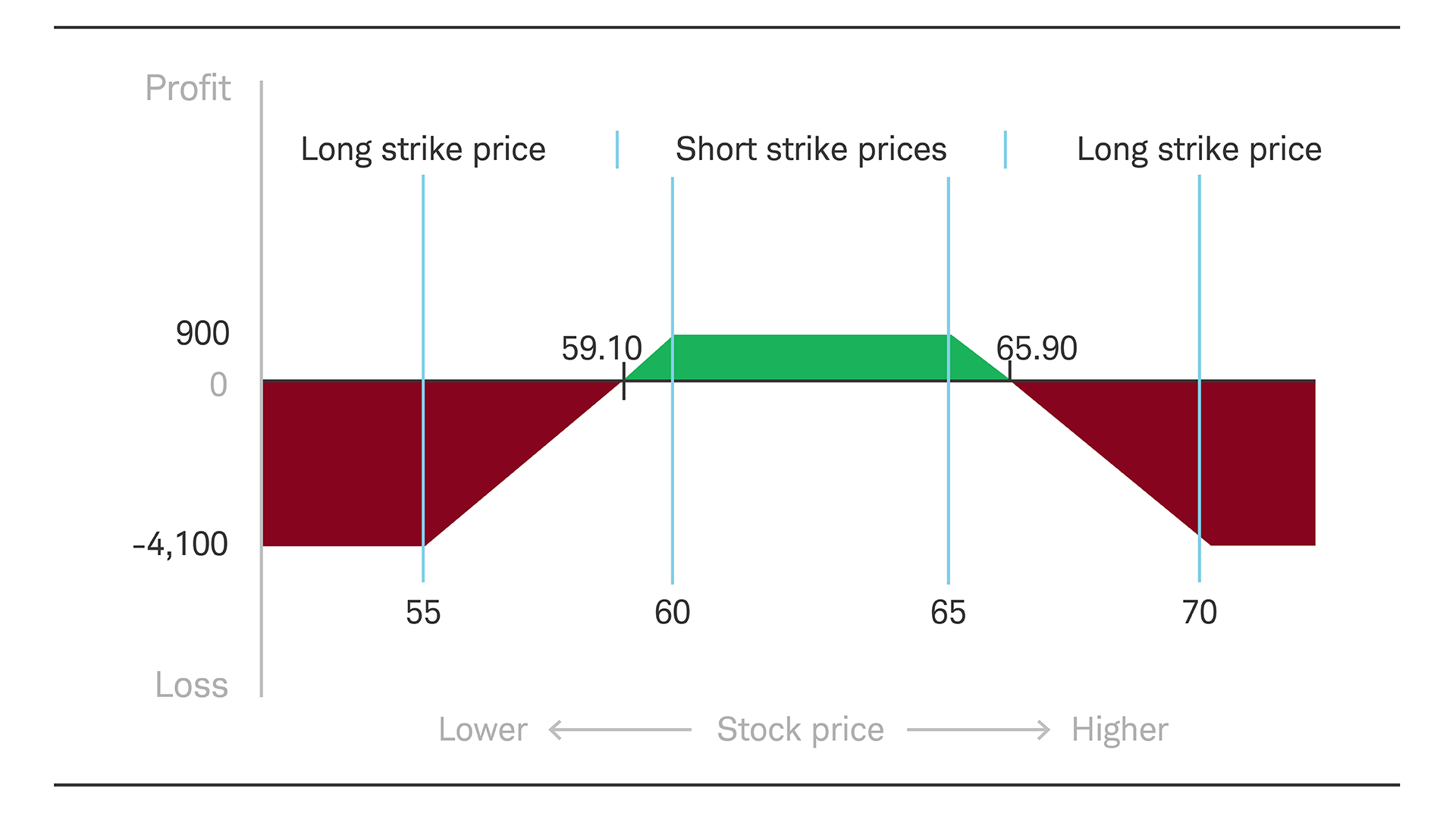

The chart below depicts the profit/loss zones of this example, including the breakeven points, at the option expiration date.

Profit and loss at expiration