Even if BlackBerry 10 succeeds, it still probably won't reverse Research in Motion's profit decline.

On Thursday it became clearer just how tough a spot RIM is in.

The company reported earnings that were less disastrous than many expected. Revenue came in at $2.73 billion, better than the $2.66 consensus. Loss per share was 22 cents instead of 36 cents. The average selling price of devices even held pretty steady, at around $235.

So the stock initially popped in after hours trading. Then it tanked.

The reason it sank after the initial euphoria? Investors began to realize that the most profitable piece of RIM's business is on shaky ground.

The Trouble With Services

That piece is service revenue. At RIM, that means the payments it collects from carriers and businesses for providing messaging and security, among other features. (Read More: RIM Stock Drops as Services Fee Changes Worry Analysts )

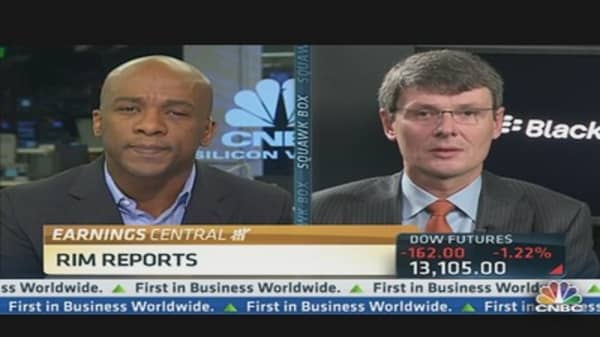

On CNBC Friday morning, I asked CEO Thorsten Heins about his statements on the analyst call suggesting the structure of service revenue would change as BlackBerry 10 launches — specifically, carriers might end up paying lower service fees for consumer and small business BlackBerry owners, with enterprise customers most likely to continue paying full freight. (Read More: RIM CEO: Service Revenue in Place, Not Going Away )

"That service revenue isn't going to go away," Heins said. "That stays intact and we're still selling Blackberry 7 devices into the market and we will continue to do so because they are pretty strong in the entry level segments and lots of regions and we will continue to do this over the next month. So the transition period from Blackberry 7 to Blackberry 10 is probably going to be one and a half to two years and that gives us really time to move from Blackberry 7 to Blackberry 10."

This implies that a major shift in service revenues will occur only as BlackBerry 10 takes off, and that continued sales of BlackBerry 7 (and the existing subscriber base of BlackBerry users) will keep those revenues healthy. But the more I dig into the numbers, the more I'm convinced that's not the case.