In the barren industrial town of Jundia in southeastern Brazil last October, thousands of workers gathered outside the local Foxconn factory in protest. But while stressful working conditions and long hours have sparked riots, and even suicides, among Foxconn's staff in China, the gripe of the Brazilians was a little different: they did not like the food in the canteen.

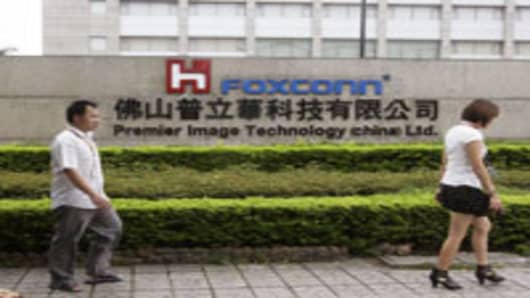

Contract manufacturer Foxconn has embarked on an ambitious expansion plan in Brazil, which the country's government says could reach $12bn of investment. Many of the plants make Apple products to help avoid import taxes on electronic goods sent from China, home to most of Foxconn's iPhone and iPad factories.

But the new factories in Brazil, where unions are historically strong, have faced challenges. In addition to the October protest in Jundia, which employs 6,000, workers there have staged protests over everything from overcrowded transport to working hours and lack of career planning offered to employees.

(Read More: Amazon Preps Smartphone, With FoxConn's Help: Report)

"Strikes really aren't that normal around here – it seems to be a problem just with Foxconn," said one official at the mayor's office in Jundia.

Taiwan-based Hon Hai Precision, widely known by its trade name Foxconn, is the world's largest contract electronics manufacturer. Its name has become synonymous with the vast Chinese factory towns where hundreds of thousands of young workers churn out everything from Apple smartphones to Dell servers.

Yet the company is expanding outside of China, to places as diverse as the US, eastern Europe and Latin America. Recently, it confirmed that it is considering further expansion in the US after Tim Cook, the chief executive of its key customer Apple, said he planned to spend more on sourcing in its home market.

Working outside of China helps Foxconn's customers get quicker turnround and avoid some import taxes. It has also created a new set of challenges for the company, which employs more than 1m people worldwide and produced 81.6bn Taiwanese dollars ($2.8bn) in net profits in its last fiscal year on revenues of T$3.45tn.

Foxconn often enters new geographical markets by taking over and turning round old factories once owned by its customers, but its famously regimented style of management has sometimes caused clashes when applied to cultures far different from the Chinese factory floors it is most familiar with.

"They really want to employ-slash-deploy the management strategy that they had in China, and that just didn't work very well here," said one former senior manager in the US. "The Foxconn structure is very autocratic and can be, I think to some people, somewhat demeaning."

Such disagreements are familiar battlegrounds for Terry Gou, Foxconn's chairman, among whose management aphorisms is the line "a harsh environment is a good thing".