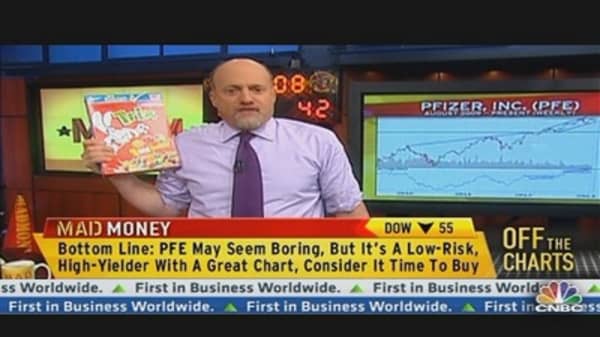

If you follow technicals a top analyst tells Cramer there's a good looking chart that will absolutely turn your head.

According to Tim Collins, a Cramer colleague from TheStreet.com, Pfizer is nearly as gorgeous as the Mona Lisa.

Well - gorgeous from a chart watcher's perspective.

Pfizer isn't exactly what most people think of as gorgeous - it's not even thought of as a big mover these days. It's thought of as an old school pharma company with a healthy dividend, but not much in the way of growth.