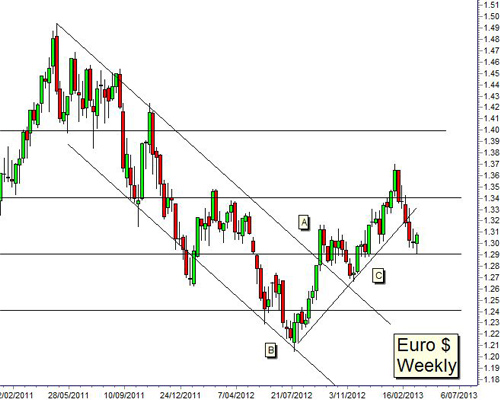

Last time we looked at the euro/dollar chart we set a potential upside target of $1.40 – if the trend remained intact. The euro/dollar moved below the trend line and this signaled a change in the analysis. The Cyprus impact is a small blip on the weekly chart.

Chart analysis is not about prediction. The objective is to identify the range of probable outcomes. Chart analysis is also about identifying the point where the balance of probability changes because this requires an adjustment of trading strategy.

Whilst the price remains above the trend line there is a high probability of action developing as discussed with an upside target near $1.40. A drop below the trend line changes the balance of probabilities. In this situation we need to look again at the structure of the market to determine the potential downside targets.

(Read More: How Tiny Cyprus Could Still Have Big Market Impact )

The trending behavior in the euro/dollar move between the support and resistance levels. The trends are interrupted by consolidation behavior at the support and resistance levels. This combination of behavior is best seen on the weekly chart.