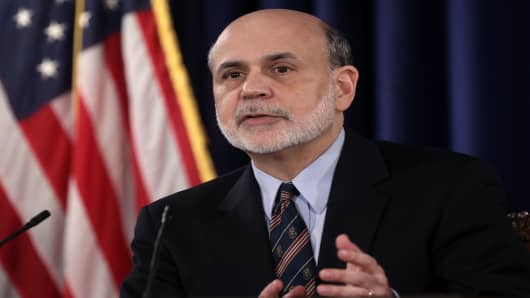

The U.S. dollar and its reaction to the Federal Reserve Chairman Ben Bernanke's Congress testimony on Wednesday will prove central for crude oil price direction this week, according to CNBC's weekly survey of market sentiment.

Nine out of 13 respondents, or about 69 percent, expect prices to soften this week while two forecast gains and the remaining two are neutral on the market.

(Read More: US Job Market Gains Could Lead Fed to Taper QE3 Early)

"This market is going to find it hard to rally," said Mark Waggoner at Excel Futures, adding the selling in gold - down almost 19 percent this year - is giving the markets more "clues" as to where oil prices are heading next. "I expect WTI [West Texas Intermediate] to hold above $90 until after OPEC [the Organization of Petroleum Exporting Countries' ministerial meeting on May 31], then lower in the first week in June. I'm bearish as dollar moves higher."

Despite expectations that Bernanke will continue to make the case for stimulating the economy through its bond-buying program at his testimony, most respondents in this week's survey expect the U.S. dollar to remain strong and press oil prices towards the lower end of their trading range.

"Strong dollar, ample supply, and lackluster demand" will continue to weigh on prices, said Tom Weber, senior commodity advisor at Portfolio Managers, Inc. Commodity Futures & Options in Los Angeles. "Of course, a rising stock market gives bulls some hope along with nonexistent producer price inflation. Looking at economic data and rising global inventories, oil is going to need some help to keep above $90 a barrel."

(Read More: Stronger Dollar Could Be New Headache for Oil Companies)

That said, oil markets late last week remained relatively immune to the greenback's gains. Oil rose for a third straight session on Friday, supported by a raft of strong economic data from top oil consumer the United States that also boosted U.S. equities, even as the dollar hit a multi-year high, Reuters reported.

Brent crude settled up 86 cents at $104.64 a barrel on Friday, after an earlier rise of more than $1.00. U.S. oil rose 86 cents to settle at $96.02, its third straight rise.

"The only thing holding crude up was the U.S. Dollar index topping out and looking overbought and failing to make new highs - without that crude would be much weaker," said Tom James, chairman and co-founder of Navitas Resources. "U.S. dollar is the key deciding factor right now."

The U.S. dollar soared against major currencies on Friday on growing speculation that the Federal Reserve could soon begin to rein in its bond-buying program and after data showed U.S. consumer sentiment hit an almost six-year high in early May. The dollar index hit a nearly three-year high, making dollar-denominated commodities more expensive for holders of other currencies, Reuters reported.

(Read More: Platts in Lockdown as Investigators Continue Oil Probe)

Capital markets will scrutinize Bernanke's testimony on Wednesday before the Senate Economic Committee for any clues on the timing of the gradual withdrawal of bond purchases. On balance, those looking for signals of a 'Fed exit' may be disappointed.

"Since official inflation is low, and unemployment especially in the U.S. remains stubbornly high, the Fed really has no reason to tap the brakes this year," said Chris Mennis, president of New Wave Energy.