Banking has grown to more than 8 percent of GDP—bigger than retail—but customer satisfaction at large national banks is lower than in almost every other major industry. Change is slow in an industry so large and steeped in tradition, so major innovations have historically come from outside the industry.

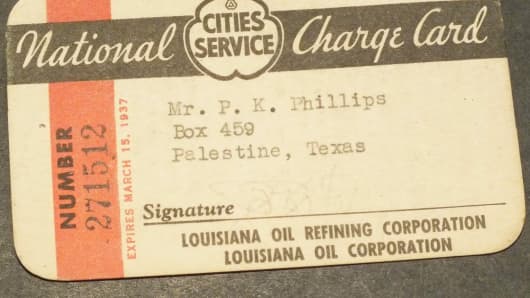

Take the credit card: it was originally a metal card introduced by hotels and oil companies in the 1920s. Then in 1949, Frank McNamara forgot his wallet while dining out at a New York restaurant. His wife had to pay the bill and Frank went on to found Diners Club, enabling New York's business elite to pay by card. This was the birth of modern charge and credit cards, and it all came from outside the banking industry. As an aside, U.S. consumers today are borrowing more than $800 billion on their credit cards (more than Greece's national debt), and it is a highly profitable business for the banks.

In contrast to the public's increasing willingness to adopt new technologies, big companies are often slow to move, so they get disrupted by more efficient new entrants. Borders is an example—by the time it opened its own e-book store, Amazon was firmly established and it was too little, too late. But it doesn't have to be this way. Savvy incumbents in many industries are getting ahead of the curve and working with disruptors to more efficiently serve customers and change their industries for the better.

(Read more: 3-D printed guns: Here is the software that is bullet proof)

Take eBay, for example. The platform started with hobbyists selling used goods, and retailers either ignored it or saw it as detrimental and tried to limit its growth. Today, companies from car manufacturers to fashion brands work directly with eBay to create tailored user experiences. In the music industry, after initially heavily resisting online distribution, record labels worked with Apple to sell music on iTunes. Now, Pandora and Spotify are disrupting that model as well. As the pace of change quickens, incumbents must keep innovating or risk becoming irrelevant.