The following is the full text of the letter:

To My Fellow Directors:

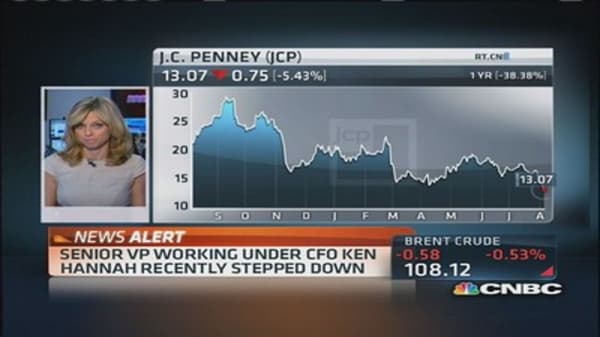

I am very concerned about the future of J.C. Penney. While I supported the decision to bring back Mike as an interim CEO, it was based on Tom's statement that we would immediately launch a search process for a long-term CEO.

It was not until the July 22nd board meeting, nearly four months later, that the board agreed to make the succession issue part of the agenda. More than two weeks have passed since the formation of the search committee and we just hired a search firm. My understanding is that the search firm intends to begin a process of interviewing directors individually to build a consensus as to the type of CEO we are looking for. This will take weeks in light of summer schedules, and is not a prudent use of time.

Considering the scale of J.C. Penney, the seriousness of the issues it faces, and the complexity of its business, there are only a handful of executives with sufficient talent and experience to take on the CEO role. We need a CEO with extensive, ideally department-store retail experience, strong operational skills, and a strong public company track record. When non-competes, geographical considerations, and other personal and timing issues are considered, the number of potential CEO candidates is quite limited.

Allen Questrom, who saved the Company once before – the stock rose from $13.94 to $39.10 during his four-year tenure – has agreed to return as Chairman of the board and assist in the turnaround as long as we hire a CEO that he supports. Allen believes that a thorough vetting of the limited potential available candidates can be accomplished in 30 to 45 days.

In light of the above, and as J.C. Penney's largest shareholder, I strongly urge that we immediately put together a short list of candidates, determine their interest level, and schedule a fast-track

interview process with the board. There is no reason that this process could not be completed in the time frame that Allen recommends.

We can't afford to wait.

Sincerely,

Bill

--Reporting by CNBC's Scott Wapner and Becky Quick; writing by Javier E. David