Greece may have been the first equity market to be downgraded from developed to emerging by MSCI, but the move generates several paradoxes amid the country's existential financial crisis. Usually, the decision would generate much negative sentiment. But the precipitating fallout from being lowered may actually fuel a boom in activity, help bolster equity prices and the general index levels at the Athens Stock Exchange.

Last week, on November 26, the last trading day before the MSCI downgrade became effective, the choppy trading value increased tenfold as fund managers negotiated the change without anyone dumping stock. In fact, banks which dominate blue chips in Athens jumped 4.6 percent. The smart money is already moving in after the downgrade taking advantage of some who left it to the last minute to run for the door.

(Read more: Mark Mobius: I'm interested in Greece)

It seems there may have been some political reasons for the MSCI downgrade beyond the usual factors such as shortcomings of securities borrowing and lending facilities, short-selling and transferability. These political risks for Athens-listed equities include civil turmoil, political instability, a lingering national bankruptcy, or a still persistent redenomination or "Grexit" risk. Even so, since the downgrade the jitters have eased and the equity market is sustaining current levels.

Greece -- other than its devalued prices and volatility -- is not exactly a high-growth play or a typical emerging market: it does not have a large growing population, and urbanization and industrialization has already occurred. It is hardly an Asian, Middle East or African growth story since it was a relatively wealthy country where incomes are falling, unemployment is close to a third and where the best and brightest are leaving. Before the downgrade, leading premier local stocks such as the heavily weighted and capitalized Coca Cola HBC moved their primary listings away. This reflected a reality that the market had lost its luster for developed market investors. Given Greece's macro challenges, for many, developed market fund managers it was off limits.

(Read more: Greece's emerging market status: Good news really?)

The general feeling about Athens has improved. The government has forecast a primary surplus this year, the country is set to end its deep six-year recession in 2014 and it is likely that its debt of 322 billion euros ($436 billion) may be restructured by backstopping lenders like the European Commission, the European Central Bank and International Monetary Fund next year, even if the real economy will take longer to bounce back.

Being in a new category, Athens will attract a larger base of potential investors because emerging markets are a smaller and riskier investment universe. It is a better fit for a specialized investor class that is more used to troubled economies and political uncertainty. Additionally, Greek stocks will double their weight on the respective indexes, even if their total index weighting lags.

(Read more: Emerging Market Switch Could Boost Greek Stocks)

The emerging market category is one where risks such as Greece's are more digestible and can be analysed more effectively since they aren't new to emerging market investors. It is likely the breadth of stocks in Athens due to benchmarking will widen beyond the top five, broadening the selection of potential investment cases. There is a grounded case to suggest that the depth to the market through increased trading activity and buying interest will lead the market significantly higher.

Even if Greek stocks' financial ratios do not appear "cheap," they may be some of the wisest and most resilient choices. After all, the companies that managed to survive an economy shrinking 25 percent in the last four years are attractive to seasoned investors since they should break out given any economic rebound.

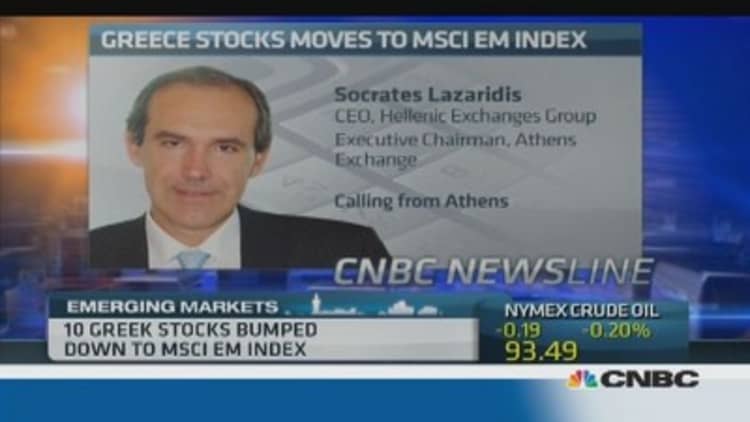

Many market experts agree that, given base case scenarios and avoiding extreme eventualities, most Athens shares are massively oversold and the upside could be significant. There will be volatility but the trading orders, whether buy or sell, will be directed at a wider range of stocks since 10 stocks are now on the MSCI index. That alone should lift the Athens Stock Exchange out of its lethargy.

(Read more: )

Anecdotal evidence is also supportive giving the rise of fund and hedge fund manager visits. Many such potential investors parachute into Athens to garner local knowledge and tap domestic experienced professionals. They are already mulling buying in on a view as to outperformance.

To rekindle demand for stocks listed on the Athens Stock Exchange it is better that the market is higher up in the category list of emerging markets rather than be at the bottom of the list in developed markets. There is the promise of tremendous gains for those that can stomach short-term volatility and are patient enough, assuming the country stays in the euro zone.

The most delightful paradox is that the downgrade will attract even fast-moving foreign capital which may actually help a nascent local recovery to achieve growth beyond the market.

Nick Skrekas, PhD is an Athens-based Greek economic analyst and has deep experience as a legal practitioner, EU adviser and lecturer to investment bankers. As a senior consultant he handles projects for the world's biggest advisory firms in Greece and the Balkans.