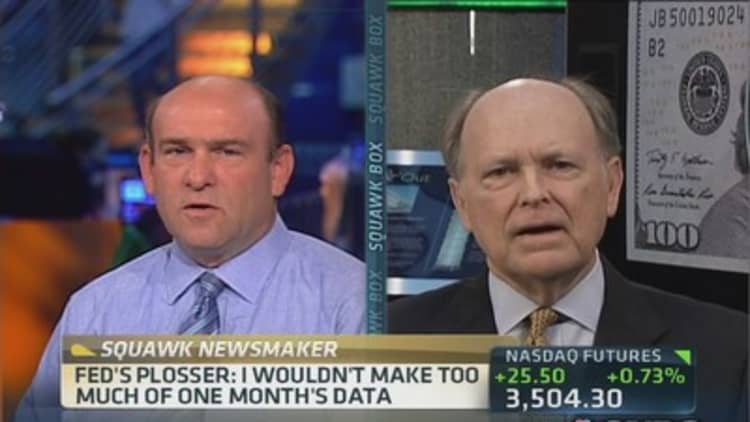

Philadelphia Fed President Charles Plosser told CNBC on Friday that it's probably time to "gracefully exit" the central bank's quantitative easing bond purchases because the November jobs report was more evidence of a strengthening economy.

The report showed nonfarm payroll growth of 203,000 jobs and an unemployment rate that dropped to 7 percent. Plosser said in a "Squawk Box" interview that the numbers show a stable, positive trend of job growth.

"It's pretty positive clearly. We continue to make solid progress," he said, but warned that investors should not to make too much of one month's report.

Investors are wondering whether the jobs data will be a catalyst for the Federal Reserve to decide later this month to start scaling back its $85 billion monthly bond purchases.

(Read more: Jobs growth good enough to start taper—but not yet)

Acknowledging that he's no fan of the current QE buying, Plosser said "it would be wise if we began to get rid of this program." He continued, "I don't think it's doing very much good for us. It has a lot of unintended consequences and risk for the economy down the road."

As an alternate voting member on the Fed's policymaking committee this year, Plosser has been one of the central bank's most consistently hawkish voices on inflation and the negative long-term effects of easy monetary policy—exemplified by the ongoing QE program that's grown the Fed's balance sheet to nearly $4 trillion. He'll be a voting member next year.

Looking ahead, he's still forecasting GDP growth of close to 3 percent next year.

When Plosser was on "Squawk Box" last month, he said the Fed "clearly missed" a chance to begin tapering in September when central bank had primed the financial markets for action.

Plosser had also said the Fed should put specific dollar limits on the size of the central bank balance sheet—an assertion he stood by on Friday.

But he added: "I think we need to go back to where we were in the earlier rounds of QE where we set a total amount, ... bought that purchase and then we stopped. Then we re-evaluated to whether or not we should go on."

—By CNBC's Matthew J. Belvedere. Follow him on Twitter @Matt_SquawkCNBC.