U.S. stocks turned lower as the close neared to end slightly lower Monday as investors looked ahead to earnings season.

"I'm not surprised. We're kind of in this limbo, waiting for earnings," said Lance Roberts, chief investment strategist at Clarity Financial.

"We're consolidating above the 200-day moving average. That's helping the 50-day moving average, which is below the 200-day moving average, to play catch up," he said.

Pfizer closed almost 1.9 percent lower. Consumer staples and health care were the greatest decliners in the S&P 500, which fell back into negative territory for the year so far. (Tweet This) Only materials and financials held gains in the close.

"In this sort of environment where the news is mixed and the valuations are pretty full, it's an ample time for uncertainties to come to the fore," said Bruce McCain, chief investment strategist at Key Private Bank.

The major indexes turned lower as the close neared, similar to Friday's sharp pullback from intraday highs to close mildly higher.

The Dow Jones industrial average ended about 20 points lower Monday after earlier adding more than 150 points. Nike contributed the most to declines, while Goldman Sachs was the top contributor to gains.

S&P 500 12-month performance

Source: FactSet

The Dow transports closed 0.48 percent lower after briefly rising more than 1 percent higher to top its 200-day moving average in intraday trade.

European stocks ended off session highs, while the STOXX Europe 600 Bank index outperformed. Fresh reports supported hopes the Italian government will soon form a plan to set up a state-backed fund that will buy bad loans held by the country's banks.

The Shanghai composite jumped more than 1.6 percent amid some encouraging inflation data.

"I just think we jumped out of the gate a little ahead of ourselves with Europe and China this morning," said Peter Coleman, head trader at Convergex.

The Japanese yen reversed in late-morning trade to resume strengthening against the U.S. dollar, last near 107.9 yen.

"The yen is still hanging tough. It's a flight-to-safety currency and perhaps you have a little bit of, the belief system in central banks is breaking down," said John Caruso, senior market strategist at RJO Futures.

Gold futures for June delivery jumped $14.20 to $1,258.00 an ounce in its best day since March 29.

U.S. crude oil futures settled up 64 cents, or 1.61 percent, at $40.36 a barrel, its highest settle since Dec. 3. Earlier, WTI hit its highest in intraday trade since March 23.

Read MoreLots to rock the market in the week ahead

The U.S .dollar index held slightly lower, with the euro above $1.14.

"If we put a low in oil and a top in the dollar in the short-term, that's very constructive for corporate America," said Art Hogan, chief market strategist at Wunderlich Securities.

No major U.S. data is due Monday. Retail sales and inflation data are expected later in the week.

Treasury yields came off highs, with the near 0.70 percent and 10-year yield around 1.72 percent.

There's "not a lot of active catalysts," said Guy LeBas, chief fixed income strategist at Janney Montgomery Scott. He noted inflation data due later in the week will help determine whether the recent rise in inflation reports is the beginning of a new trend.

Read MorePlaying the long game? Tune out the Fed

U.S. President Barack Obama is happy with the job done by Federal Reserve Chair Janet Yellen, with whom he is meeting on Monday to discuss regulatory issues and world economy, the White House said in a Reuters report.

"The president has been pleased with the way she has fulfilled what is a critically important job," White House spokesman Josh Earnest said at a news briefing.

Separately, Dallas Fed President Robert Kaplan said he is not willing to back a rate hike now but is "very open-minded" to making such a call ahead of a mid-June policy meeting, Reuters reported.

In prepared remarks for a Monday morning speech, New York Federal Reserve Bank President William Dudley focused on the links between economic and geographic mobility in the United States and did not comment on monetary policy or the economy, Reuters said.

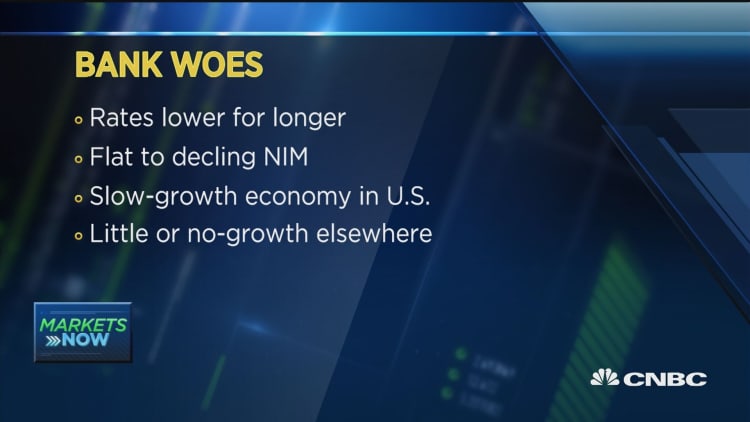

Alcoa is set to unofficially kick off the first-quarter reporting season with its earnings after the close, while major banks such as JPMorgan Chase, Bank of America and Citigroup are all due to post results later in the week.

"I think the focus this week will be on earnings. The challenge will be, can investors stomach current valuations?" said Jack Ablin, chief investment officer at BMO Private Bank.

Aggregate first-quarter S&P 500 earnings are estimated at $26.17, representing a decline of 8.1 percent year-over-year, for the third quarterly decline in a row, according to a Friday note from Lindsey Bell, senior analyst at S&P Global Market Intelligence. "Such a steep decline in growth hasn't been recorded since second-quarter 2009," she said.

U.S. stock index futures held higher ahead of the open, with Dow futures up about 70 points.

"Perhaps investors anticipate this is going to be the worst quarter of the year and maybe brighter skies ahead," Ablin said.

Major U.S. Indexes

In corporate news, Goldman Sachs will pay $5 billion to settle government probes into the firm's sale of mortgage-backed securities prior to the financial crisis, the Justice Department announced Monday.

Asian stocks closed mixed overnight, with the Nikkei 225 falling 0.44 percent while the Shanghai composite gained more than 1.6 percent.

China's producer prices declined a less-than-expected 4.3 percent in March from a year earlier while consumer prices were unchanged from February's rate with a 2.3 percent rise last month.

U.S. stocks closed well off session highs Friday, despite a rally in oil, as the yen strengthened against the U.S. dollar.

The major averages declined more than 1 percent for the week, the worst since Feb. 5 for S&P 500 and Nasdaq composite and the worst since Feb. 12 for the Dow Jones industrial average.

Read More Early movers: NSC, YHOO, HTS, GOOGL, OSTK, GE, BLMN, QSR, GM & more

The Dow Jones industrial average closed down 20.55 points, or 0.12 percent, to 17,556.41, with Goldman Sachs leading advancers and Nike the greatest laggard.

The closed down 5.61 points, or 0.27 percent, at 2,041.99, with consumer staples leading eight sectors lower and materials leading advancers.

The Nasdaq composite declined 17.29 points, or 0.36 percent, at 4,833.40. The iShares Nasdaq Biotechnology ETF (IBB) closed 1.68 percent lower.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, rose more than 5.5 percent to near 16.3.

About three stocks advanced for every two decliners on the New York Stock Exchange, with an exchange volume of 892 million and a composite volume of nearly 3.5 billion in the close.

—CNBC's Patti Domm and Reuters contributed to this report.

On tap this week:

Tuesday

Earnings: Fastenal, CSX, Adtran

6 a.m. NFIB survey

8:30 a.m. Import prices

9 a.m. Philadelphia Fed President Patrick Harker

1 p.m. $24 billion three-year note auction

2 p.m. Federal budget

3 p.m. San Francisco Fed President John Williams

4 p.m. Richmond Fed President Jeffrey Lacker

Wednesday

Earnings: JPMorgan Chase, Commerce Bancshares, Pier 1 Imports, Kinder Morgan, Noble

8:30 a.m. Retail sales; PPI

10 a.m. Business inventories

10:30 a.m. EIA oil inventories

1 p.m. $20 billion 10-year note auction

2 p.m. Beige book

Thursday

Earnings: Bank of America, BlackRock, Wells Fargo, PNC Financial, First Republic Bank, Freeport-McMoRan, Snap-on, Advanced Micro, Delta Air Lines, Shaw Communications, Infosys

8 a.m. Bank of Japan Governor Haruhiko Kuroda at CFR, New York

8:30 a.m. Jobless claims

8:30 a.m. CPI

10 a.m. Atlanta Fed President Dennis Lockhart

10 a.m. Fed Gov. Jerome Powell at Senate Banking subcommittee

1 p.m. $12 billion 30-year bond auction

Friday

Tax day

Earnings: Citigroup, Charles Schwab

8:30 a.m. Empire State survey

9:15 a.m. Industrial production

10 a.m. Consumer sentiment

12:50 p.m. Chicago Fed President Charles Evans

4 p.m. Feb TIC data

*Planner subject to change.

More From CNBC.com: