It's make-or-break time for the big banks this week as JPMorgan, Citigroup and Wells Fargo gear up for earnings Friday morning.

Financials were staging a comeback Thursday morning, with the XLF ETF rallying more than 1 percent. Despite the surge, the group is still the worst-performing sector in the past month. However, "Options Action" trader Mike Khouw says a recent spike in options activity for the group could suggest the tides are about to change.

"The XLF saw above-average activity this week," Khouw said Wednesday on CNBC's Fast Money. "[Thursday] we saw approximately 1.5 times the average daily volume."

Three of the financial ETF's top holdings — JP Morgan, Citigroup and Wells Fargo — are expected to move around 3 percent in either direction when they report this Friday. Of the group, Khouw suggests investors keep a close eye on Wells Fargo.

"I think Wells Fargo right here is the one we want to look at," Khouw said. "This is the one that has a little bit of idiosyncratic risk going on."

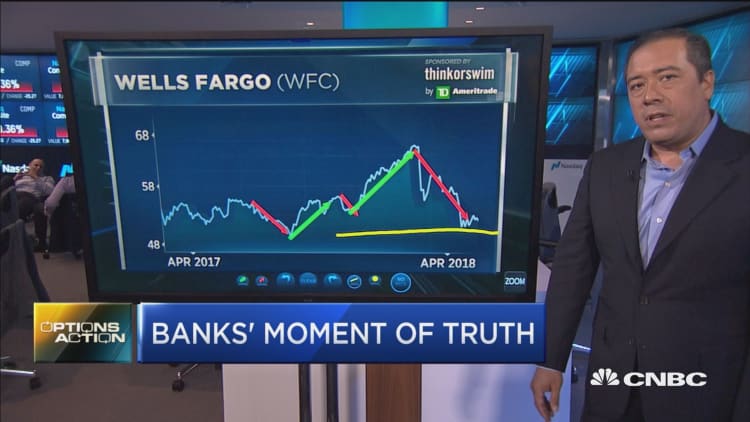

Wells Fargo has tumbled this year, now down more than 14 percent since January. The California-based finance company has struggled to maintain steady gains after its major fake accounts scandal broke back in 2016. However, Khouw points out that a recent trading pattern in the charts has demonstrated a resilience in the stock.

"Constantly, we have these controversies coming out and the stock sells off on the bad news but then actually recovers a little bit," he explained.

Wells Fargo surged more than 30 percent from its September 2017 low to its January 2018 high. Since then the stock is down more than 20 percent, but Khouw expects support to be held around $50 and for the stock to "catch a little bounce" off the level out of earnings.

Wells Fargo reports before the bell on Friday. Last quarter the bank missed on both revenue and earnings per share expectations and traded lower on the session.

Shares of Wells Fargo were trading around $52.55 early Wednesday afternoon.