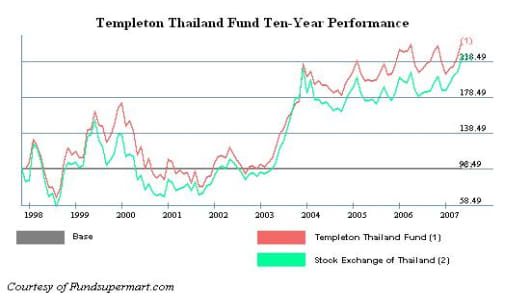

Talk about a case study in the old age that you can’t time the market.

Franklin Templeton Investment Funds launched its Thailand fund on June 20, 1997, just two weeks before the float of the Thai baht, which triggered the Asian Financial Crisis.

The fund’s manager, Mark Mobius, says there were hints that the Thai baht was overvalued, but also a sense that such market conditions usually correct themselves without much upheaval. As things turned out, the correction was a regional selloff in stocks and currencies.

"We continued to focus on buying stocks that traded at significant discounts to their intrinsic values," Mobius recalls about his reaction to events back then. "The only change was there were plenty of bargains after the crisis."

The fund was started to capitalize on Thailand long-term growth, and Templeton’s strategy hasn’t changed since its inception: Look at earnings and cash flow five years out; factor in macro events and country politics; and then select companies with the most attractive valuations. Templeton also favors stocks that trade at discounts to asset value, have good dividend yield and a strong balance sheet.

Thailand has recovered nicely from the financial crisis that started on July 2, 1997, with gross domestic product far above pre-crisis levels, but Thai stocks have not performed as well as those in neighbouring Malaysia and Singapore. Most market watchers say investing in Thailand today poses a big risk because of the ever present political instability.

Just last September, Thaksin Shinawatra, the then Prime Minister, was ousted in a military coup. The military canceled scheduled elections, suspended the Constitution, dissolved Parliament, banned protests and all political activities, suppressed and censored the media, declared martial law, and arrested Cabinet members.

This was the prelude to the botched attempt by the government to impose capital controls this past December, which triggered a 15% drop on the SET index in just one session – the worst rout for that market since the Asia crisis of 1997. These measures were for the most part, reversed.