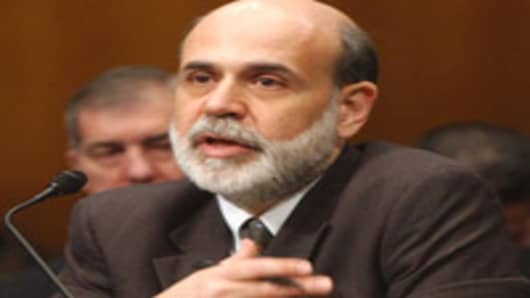

Federal Reserve Chairman Ben Bernanke said the U.S. and other countries must work together to correct the global imbalance of trade and investment, offering no clue about whether the central bank will cut rates at its Sept. 18 meeting.

So-called "global imbalances" occur when countries such as the U.S. run up bloated trade deficits, while other countries, such as China and oil-producing nations, produce big trade surpluses. The International Monetary Fund has been

leading efforts over the years to reduce lopsided trade and investment patterns.

As for prospects of fixing the problem, Bernanke said, "Signs of progress have

appeared but ... most countries have only just begun to undertake the policy

changes that will ultimately be needed." He spoke at a conference in Berlin.

Copies of his remarks were made available in Washington.

Scholary Speech

Bernanke's scholarly speech did not address the future course of interest rates

in the U.S. nor the state of the U.S. economy.