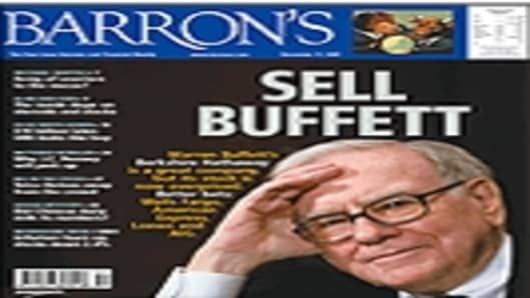

Berkshire Hathaway shares closed down 4.6 percent today (Monday) at $136,400 after a cover story in Barron's over the weekend recommended, "Sell Buffett: Sorry, Warren, Your Stock's Too Pricey." That erased just over $7 billion in Berkshire's market value in one day. Buffett-Bulls, however, see a buying opportunity in today's decline.

The close was a bit better than the day's low, which was $134,050 in the late morning, a drop of 6.3 percent. Berkshire closed Friday at $143,000.

Current price:

The Barron's piece is now free content at the Barron's web site. (It had been behind a paid subscription wall this weekend and earlier today.)

While Barron's acknowledges Buffett and Berkshire have "dodged the mortgage and credit problems" afflicting so many financials and Buffett's "star has never been brighter," writer Andrew Bary concludes, "The Street's enthusiasm ... might be excessive."

Taking its cue from Buffett's own value-oriented way of looking at potential investments, Barron's says Berkshire "now appears overpriced, reflecting a sizable premium for the skills of the 77-year-old Buffett."

The magazine acknowledges it is very difficult to determine Berkshire's "intrinsic value - the discounted value of the cash flow from its businesses." But using a "generous" price-to-earnings ratio for its non-insurance businesses, Barron's estimates the company is now worth around $130,000 a share, 10 percent below Friday's close.

Barron's cites, with help from Credit Suisse analyst Charles Gates: