Fesharaki told me everything above $105 is speculation. “Something like $50 to $100 billion dollars has poured into the market in the last two months,” he said. Speculators know the limits are reached so you go to this level and expect a major retreat afterwards.”

Do prices have scope to move even higher?

Goldman Sachs – who were one of the first to call for $100 a barrel oil – believe so. Jeff Currie, head of commodity research at Goldman,forecast $150 by the year-end. The likelihood of hitting that target sooner “has increased tremendously” and it could happen this summer. “The supply picture is weak,” he said, adding declining output in Russia, Mexico and Venezuela will contribute to higher prices.

Another major theme at the summit -- will demand hold up in Asia in the aftermath of fuel price increases and potential demand erosion?

The broad mood here is that the industry is still largely upbeat about the regional demand outlook. There’s a belief that it’s too early to call whether we’ll see a reversal such as the one taking place in the U.S. as consumers flinch at the sticker-shock of $4 a gallon gasoline.

BP chief executive Tony Hayward in his State of the Industry address remained bullish on demand. “In China about 350 million people aspire to and can afford an urban way of life and in India the number is 250 million,” he told delegates. “This means that there are hundreds of millions of people still waiting to make the transition from a rural to an urban way of life. And that transition is going to require yet more energy.”

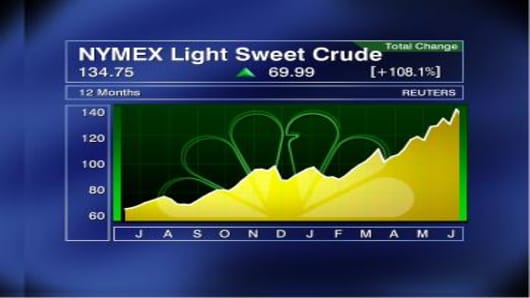

Oil prices have pulled back, offering some momentary respite for the global financial markets. But if recent history is any guide, past corrections have been false dawns providing, if anything, an opportunity for buyers to come back in.

If there is a sliver lining, many delegates here at the Asia Oil & Gas Summit agree with George Soros’ view that the oil market bears all the hallmarks of a bubble. Saying when that bubble will burst is the billion-dollar question.

Send Sri your questions and comments at commoditystore@cnbc.com.