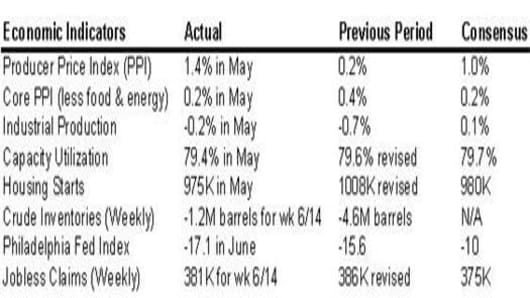

For the week ending Friday, June 20, 2008, the markets dropped on disappointing earnings results from the financial sector, and a continued spike in crude oil prices added to investors' concerns over inflation. The Dow closed below 12,000 on Friday for the first time since Mid-March.

Next week, the markets will closely follow economic events such as, GDP figures, Durable Goods Orders, and an awaited FOMC meeting on Tuesday. The next big batch of earnings will come mostly from retailers such as Walgreen's, Bed Bath & Beyond, and Finish Line as well as tech giants, Oracle and Research in Motion.

Highlights:

M&A, Deals, Corp Actions:

- Yahooand Google expanded their partnering as the two companies agreed to allow their Instant Messaging users to communicate with one another. This comes a week after both companies signed a search-advertising pact. Shares of Yahoo and Google were down 6.31% and 4.39%, respectively for the week.

- Huntsman Corp. shares tumbled 38% on Thursday, as the company is being sued by Apollo Management and Hexion Specialty Chemical over a termination of a previous merger agreement.

- Apria HealthCare Group will be acquired by Blackstone Group , in a deal valued at $1.6B. Shares of AHG rallied 26% on Thursday on the acquisition news.

- Brittania Bulk Holdings , an ocean-shipping services company fell 7.6% on Wednesday during its initial public offering price of $15/share.

- Cadence offered a $1.5B takeover bid for Mentor Graphics , a microchip design software maker. Mentor rejected the unsolicited offer due to the risk associated with regulatory approval and an insufficient price to support the deal, the company said. Shares of CDNS fell 6.2%, while shares of MENT surged 27% for the week.

- Landry’s Restaurants agreed to a total buyout offer of $1.3B by its CEO, Tilman Fertitta. The restaurant chain’s stock finished up 11.3% for the week on the news.

- Allied Waste and Republic Services announced discussions of a possible merger valued at $6.59B, which could help the companies to obtain a competitive advantage. Shares of both companies, Allied Waste and Republic Services, dropped 9.6% and 7.9% respectively for the week.

- Shares of XM Satellite Radio and Sirius advanced at the beginning of the week after the Wall Street Journal reported that the Federal Communications Commission recommended approval of the planned multi-billion dollar deal; however, the companies stocks tumbled 23.6% and 21.7% respectively on negative recommendations from Goldman Sachs, which stated that demand for satellite radio has declined.