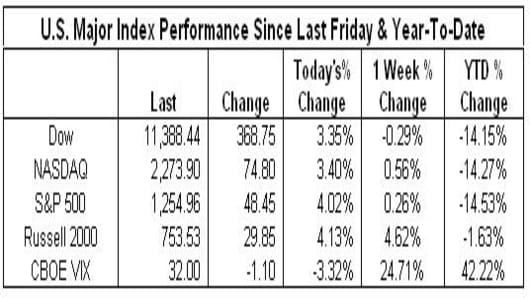

On a week where Financials once again dominated the market with unprecedented moves by the U.S. government, the Dow trades in an over 1000 point range for its biggest 2-day gain since March, 16, 2000, when the Dow moved 819 points in two days, vs. the current 778 point move. The major indexes all end approximately flat for the week with the NASDAQ & S&P slightly positive and the Dow marginally negative for the week.

*The CBOE Volatility Index hit a 52-week high of 42.16 on Thursday and closed above 30 on Friday. Levels above 30 tend to indicate high levels of investor fear and uncertainty.

-JPM had the most positive impact on the Dow and the S&P 500 up over 14% for the week

-AIG had the most negative impact on the Dow, down over 68% for the week

-Microsoft had the most negative impact on the S&P 500 and the NASDAQ 100, down almost 9% for the week

-Cisco Systems had the most positive impact on the NASDAQ 100 up almost 4% for the week

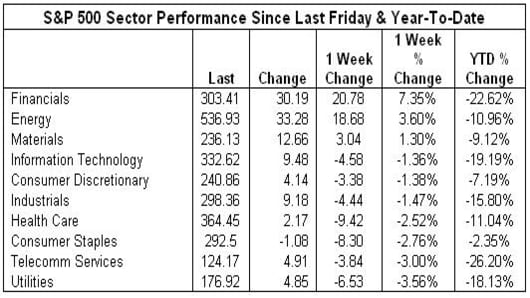

The S&P 500 sectors were mixed this week led by Financials up over 7% for the week, while Utilities were the most negative sector, down almost 4% for the week.

-Financials were boosted by Merrill Lynch up over 73% for the week

-Utilities were dragged down by Constellation Energy down more than 55% for the week even with the Buffett news

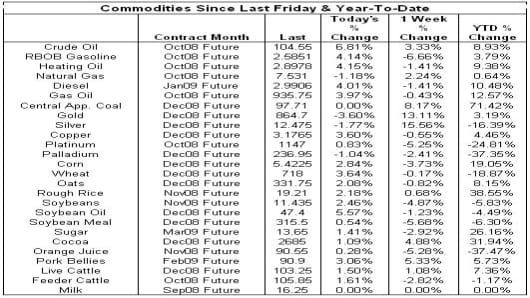

Commodities rallied Friday on sentiment that the U.S. government rescue plan will avert the financial crisis and increase demand.

-Precious metals rallied on a flight to quality, as gold for December delivery rose more than 13% this week.

-Oil closed Friday up almost 7% after touching $90 per barrel earlier in the week, to close at $104.55.

-Wheat, corn and soy futures rallied on Friday all up close to 3% or better

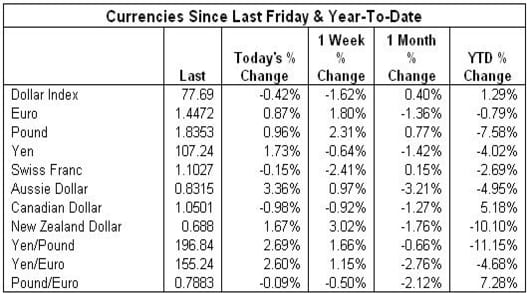

The U.S. Dollar was weaker Friday as investors sought riskier trades in higher yielding currencies.

-The yen fell against the dollar and the euro as trader's move out of the safe-haven plays.

Commodities rallied Friday on sentiment that the U.S. government rescue plan will avert the financial crisis and increase demand.

-Precious metals rallied on a flight to quality, as gold for December delivery rose more than 13% this week.

-Oil closed Friday up almost 7% after touching $90 per barrel earlier in the week, to close at $104.55.

-Wheat, corn and soy futures rallied on Friday all up close to 3% or better