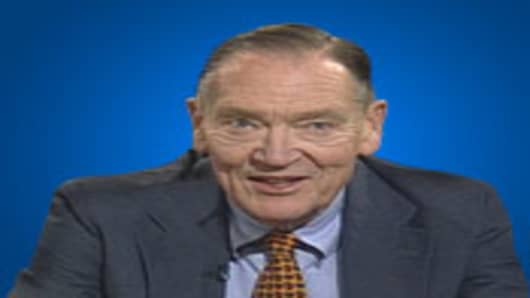

The fundamentals of the U.S. stock market have "improved radically" and declines in valuations are overblown, legendary investor and Vanguard Group founder John Bogle said Tuesday.

"It seems to me that people have lost sight of the fact that the fundamentals have improved radically," said Bogle, who launched the colossal Vanguard 500 Index in the mid-1970s as a low-cost investment strategy.

"The value of the U.S. stock market was $18 trillion a year ago. And now it's about $9.5 trillion or let's call it $10 trillion with today's rally. Anyone who believes that American business is worth $8 trillion less than it was a year ago I think is a fool," he told Reuters in a telephone interview. (See Bogle's thoughts on the economy and the election of Obama in the video below.)

"Will it be worth a lot less than that and the market is anticipating it is a reasonable question," he added. "Was it somewhat overvalued at the start is an even more reasonable question, one which I would answer in the affirmative.

"So there was some water in the system, some hot air in the system, and we blew it out but I think we have overblown it," he said.

The hard-driving 79-year-old left the Vanguard helm after a 1996 heart transplant, and now often castigates the mutual fund industry as a marketing vehicle run not so much by investment professionals on behalf of investors as by entrepreneurs in search of short-term profits.

A month ago, Bogle told CNBC that the stock market bloodbath was probably more than halfway over.