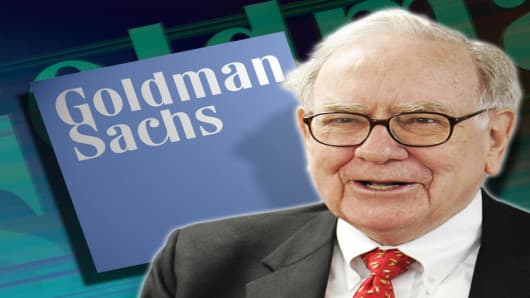

Warren Buffett drives a hard bargain. When he invests billions in a company, he can generally get a better deal than the rest of us.

First, he's spending billions. And second, his money carries a 'vote of confidence' from the world's most-respected investor.

That helps explains why Buffett was able to get a very healthy 10 percent annual return on the $5 billion he pumped into Goldman Sachs in late September at the height of the credit crisis.

He didn't stop there, also getting the right to buy another $5 billion in common stock at what was then the below-market price of $115 a share.