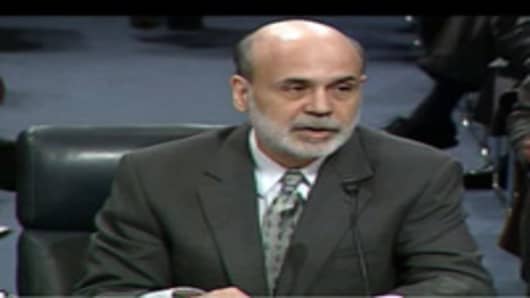

The case that Bernanke makes to Congress not to change anything substantive for the Fed can be distilled down to this: We helped fix a problem that we helped create and therefore we should keep our present responsibilities. But as Bernanke says, "The Federal Reserve, like other regulators around the world, did not do all that it could have to constrain excessive risk-taking in the financial sector in the period leading up to the crisis."

As the Brits would say, it's a bit cheeky and Congress is showing they're not buying it. Thanks to Ron Paul, Congress is looking at all aspects of the Federal Reserve and it's functions. The biggest concern appears to be of an audit of the Federal Reserve's monetary policy decisions. This could potentially insert "politics" into the Fed's decision making and erode their inflation fighting ability. However, the Fed has been a political animal ever since Congress created it in 1913.

Given the near collapse of the financial system in 2008, I think it's entirely healthy for a top to bottom review of exactly what the Fed does and its powers to control the taxpayers money, i.e., the balance sheet. The framers of the constitution gave control of this power specifically to the elected members of Congress for a reason: to make them accountable to those being taxed. The Fed as a fourth branch of government is of great concern.

In this vein, an amendment to the 1913 Federal Reserve act in 1978 created what we now call the dual mandate for the Federal Reserve. Federal Reserve Governor Miskin wrote, "According to this legislation, the Federal Reserve's mandate is "to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." Because long-term interest rates can remain low only in a stable macroeconomic environment, these goals are often referred to as the dual mandate; that is, the Federal Reserve seeks to promote the two coequal objectives of maximum employment and price stability."

He goes on to make this point: "In a democratic society like our own, the ultimate purpose of the central bank is to promote the public good by pursuing a course of monetary policy that fosters economic prosperity and social welfare." Does the dual mandate accomplish this or does it work against it?

Over the last decade, I believe we've seen the Federal Reserve act more towards their perceived goal of maximum employment than price stability and have come up short on both counts. What else would you call a housing price bubble of colossal proportion and a subsequent 10.2% unemployment rate? Given these metrics, we need to ask how should the Fed change to give the economy what it needs to achieve growth and thereby employment.

To me, the simplest answer comes to mind. The Fed should be solely concerned with price stability and get out of the way. It's through stable prices that individuals and companies can make optimal decisions for work and for investment to create jobs. As Ben Bernanke appears today before the Senate Finance committee, I recommend that at least one senator ask the chairman if this should be the way forward.

________________________

Andrew B. Busch is Global Currency and Public Policy Strategist at BMO Capital Markets, a recognized expert on the world financial markets and how these markets are impacted by political events, and a frequent CNBC contributor. You can comment on his piece and reach him hereand you can follow him on Twitter at http://twitter.com/abusch.