We'll say right up front that there is a greater risk for a bout of deflation through the medium term than for inflation to even rise back into the Fed's implicit comfort zone. Let us say it again for effect: far greater risk.

This is not a call we feel we're going out on a limb on. Resource slack by any measure is significant and final sales at this point of the "recovery" should be far stronger. But our base case remains for continued disinflation not outright deflation. This view is predicated on our call that while we have long been in the slow growth camp, there should be some growth nonetheless.

The headwinds are significant as our regular readers know we have long highlighted. But we reject the notion that the US backdrop is a replay of the Japan lost decade experience. This view fails to appreciate the fundamental differences in our economies then and now. As we answer in the headline above: this is not Japan.

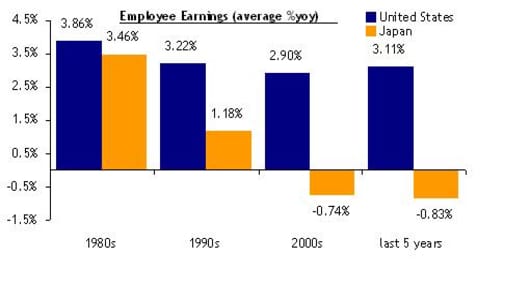

We think there are meaningful differences between the US today and Japan during the '90s. High on our list is the difference in wages. A straight forward construct of inflation reveals employee earnings are a primary driver. During the early part of the 1990s wages in Japan were averaging around 2.0%.

In contrast, over the last several years in the US we have averaged just over 3.0% growth. Place this outcome in context. We just came through one of the worst job cycles since the Great Depression and employee earnings held up remarkably well. This suggests wages are unlikely to be a source of additional deflationary pressure.