Stocks crossed an important threshold Monday, and closed sharply higher, but technicians are seeing mixed signals in the recent action.

The S&P 500 sailed through the key 1130 area to close up 17 at 1142. The Dow was up 145, or 1.4 percent to 10,753.

Barclay's technical strategist Jay Govender said Monday's levels may not hold, and the market could retest the 1130 area because the volume did not confirm the move. "We do expect this level to be retested, and probably hold the second time," he said. Monday's consolidated NYSE volume was 3.5 billion, below the September average of 3.8 billion and the August volume of 4 billion. It is also more than 30 percent below volume at this time last year.

Scott Redler of T3Live.com, however, said he thinks the market is setting up for a quick run to the 1155-1160 level.

"Everyone's trying to make an excuse for why they're not involved in this market, while the leading stocks are marking new highs and even historic highs. Apple today made a historic high. Baidu made a historic high. Amazon made a historic high," said Redler.

The big event for markets this week is Tuesday's Fed meeting, which ends with a 2:15 p.m. statement. Fed watchers expect the Fed to hold off on expanding its quantitative easing program to include substantial purchases of Treasurys. It currently is buying Treasurys with the proceeds of the maturing mortgage securities in its portfolio, in an effort to keep the size of its balance sheet steady.

Some economists believe the Fed would not announce "QE2" until the end of the year though it may tweak the language in its statement, providing clues on its thinking, its view of the economy and what might trigger more Treasury purchases. With its target Fed funds rate at zero, the theory is that QE would help push Treasury rates lower, impacting a range of lending rates.

"I don't think the Fed (statement) would move the (bond) market much. Maybe they'll disappoint the equities market a little by not announcing QE. I don't think it will have much affect on rates. I think the market has come to the conclusion that QE is not on the table. It (the bond market) would respond a little if the Fed does alter the language," said Jefferies Treasury strategist John Spinello.

Pimco senior market strategist Tony Crescenzi says the market is focused on whether the Fed will trim its 2011 economic forecast, and what exactly would prompt it to agree to more QE, as well as what specific actions it would consider. "The Fed is likely to stand pat oat Tuesday's FOMC meeting, at most setting the table for additional quantitative easing, but serving no meal," he wrote in a note.

Tuesday's data includes housing starts, which are expected to come in at 545,000, and building permits, expected at 560,000. The data is released at 8:30 a.m. The National Association of Home Builders survey is released at 10 a.m.

Earnings are expected from AutoZone, Carnival and ConAgra before the bell.

Adobe Systems , Cintas , and Darden report after the bell.

Monday Replay

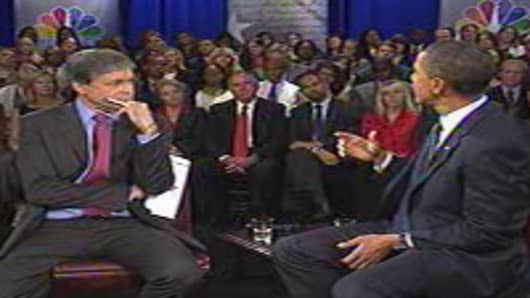

President Obama appeared on CNBC for an hour-long town hall Monday. The market held its gains and moved higher after he spoke, even though traders said he did not provide any new information for investors.

The president appeared not long after the NBER declared that the recession ended in June, 2009 and said the 18-month recession was the longest in the post World War II era.

"A lot of traders were a little worried stocks were going to rally into President Obama and then sell the news..but today we're getting a healthy breakout," said Redler. He said some traders thought there was a chance Obama would show more flexibility on extending the Bush tax cuts for wealthier tax payers.

Obama did say he was considering the idea of a corporate tax holiday, along with other proposals. But he stuck to his position that the wealthiest Americans should pay more taxes.

"He was less belligerent toward businessmen. He was confronted with questions that were pretty specific and he avoided looking anti-business but stood his ground with respect to taxes, I believe. It doesn't mean it will be altered, but he said he was looking at everything," said Spinello.

Whither Markets

Gold continued its race higher Monday, finishing at $1,279, another record. The idea of QE has been supporting gold prices, so the Fed meeting is being watched closely by traders.

The dollar Monday fell against major currencies ahead of the Fed meeting. The euro was at $1.3061 Monday.

Redler said the 1130 level on the S&P 500 was last challenged around the Aug. 10 Fed meeting, but it failed at that time. The market also failed to breakout above it June 21, and the last time it closed above that level was in May. "This opens the door for a short-term move to 1155 to 1160, and even 1180 to 1200 by year end. Today's break was clean enough that it puts a high probability that we'll see 1155 to 1160 pretty quickly," he said.

However, Mary Ann Bartels, technical strategist with Bank of America Merrill Lynch, said, in a note, that the market's resistance is being tested with mixed signals. She noted that the AAII Bull/Bear ratio last week signaled a contrary sell signal, just four weeks after it gave a contrary bullish reading. Previous sell signals were in April and May 2006, January and February, 2007, October 2007, May 2008 and January 2010. She said all those periods saw at least a short term pull back for the S&P 500.

Bartels also warned that October is usually the month when key bottoms are made. She too noted that volume is not great. "We still need to break and hold above S&P 500 1150 to invalidate a potential head and shoulders distribution top. A test of the July low (1010) is still not ruled out. A break above 1150 would point to a retest of the April high of 1220," she wrote.

Bartels, in the note, also said long/short hedge funds are positioned defensively and if the market breaks resistance levels, short covering and outright buying would occur. She estimates hedge funds reduced their holdings to 17 percent, well below the average bench mark 35-40 percent net long.

What Else to Watch

Secretary of State Hilary Clinton is in New York to meet with foreign leaders from Ireland, Uzbekistan and others at the UN. President Obama speaks at the UN General Assembly Thursday.

Treasury Secretary Tim Geithner and special adviser Elizabeth Warren host a mortgage disclosure forum at 1:00 pm ET.

- Follow me on Twitter @pattidomm.

Questions? Comments? Email us at marketinsider@cnbc.com