Goldman executives have long maintained that they were not making a massive bet against the US housing market. The short positions, Goldman insists, were merely hedges against other, long positions the firm was taking.

But in the views of the people executing those trades, this is backward. By the time Goldman began building The Big Short, the firm was already fully hedged. The Big Short was a directional trading position on the market—something so close to how a hedge fund might trade that one Goldman trader argued that his group should be compensated like hedge fund managers.

In September of 2007—following the collapse of those Bear Stearns hedge funds—Goldman publicly revealed in its quarterly report that it had positioned itself to profit from the collapse of subprime mortgage values. In a press release, Goldman said that “significant losses” on some positions were “more than offset by gains on short mortgage products.”

Wall Street was stunned. Then-Merrill Lynch analyst Guy Moszkowski said Goldman's trading results were $1.7 billion above his forecast. The move seemed to confirm that Goldman was operating on an entirely different level than everyone else—it was faster, smarter, better than its Wall Street rivals. Goldman’s chief financial officer declined to say just how much the firm earned though the short play, but he did say it was executed across the entire mortgage desk.

When Peter Eavis at Fortune reported on the gains—under the title “How Goldman Defies Gravity”—it caused some turmoil inside the firm. Top Goldman executives did not like the implication that Goldman was placing “bets.” They preferred a narrative in which Goldman’s strength was the firm’s “franchise strength” rather than its trading desks’ prowess at picking a winning position.

Goldman spokesman Lucas Van Praag emailed the article to eight top Goldman executives.

“Once again they completely miss the franchise strength and attribute it all to positions and bets,” then-Goldman president Jon Winkelreid wrote back in a “reply to all” email.

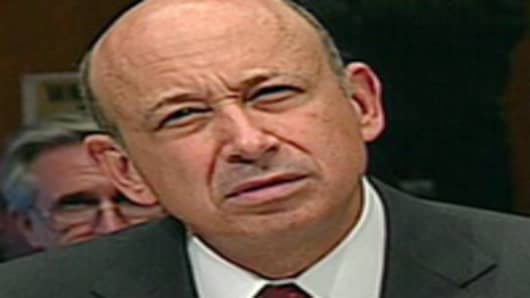

Blankfein weighed in next, claiming that the short position had reduced the firm’s estimates of the market risk on its balance sheets—its value at risk, or VAR. A position that reduces firm-wide VAR can fairly be characterized as a hedge for the company.

“Also, the short position wasn’t a bet. It was a hedge. Ie, the avoidance of a bet. Which is why for a part it subtracted from var, not added to var,” Blankfein wrote.

But Blankfein appears to have gotten this wrong.

By June of 2007, Goldman Sachs had no net mortgage position to hedge, according to testimony before the Senate investigations committee. Josh Birnbaum, one of the chief architects of Goldman’s short strategy, testified that “all retained CDO and RMBS positions were identified as already hedged.”

“In other words, the shorts were not a hedge,” Birnbaum wrote in a presentation prepared in September of 2007.

The facts seem to bear out Birnbaum’s view. In the months of June and July of 2007, Goldman built a $13.9 billion short position in mortgages, according to the Senate report. Much of these positions were accumulated following the collapse of the two hedge funds run by Bear Stearns.

These positions drove the VAR of Goldman’s mortgage desk—and the firm as a whole—to an all-time high, according to the report. The mortgage department’s VAR had increased from around $13 million in mid-2006 to around $113 million in August 2007—far in excess of the desk’s VAR limit of $35 million. This one corner of Goldman, which had never contributed more than 2 percent of Goldman’s revenue, was now responsible for 54 percent of all the risk the firm was taking.

Goldman’s top executives started issuing orders for the mortgage desk to “get down now”—meaning reduce its short exposure and get closer to flat. Value at risk was driven down not by taking the short position—as Blankfein wrote in his email—but by reducing the short position—buying up mortgage assets to cover the short.

No doubt Goldman executives will still dispute this account of things. Birnbaum’s presentation in which he claimed the position was not a hedge but a bet was written to advocate that he and his team get paid larger bonuses as a reward for calling the market so well—which could undermine his credibility on this point. No doubt they’d also argue that the traders at the mortgage desk just didn’t understand the broader position of Goldman in the market. “Franchise strength” and all that.

But it certainly does appear that top Goldman executives wanted to embrace the narrative early on that it was hedging rather than outsmarting the market. And, within Goldman, there were those who were convinced that they really were just smarter and better than the rest of Wall Street.

Goldman Sachs didn't immediately return calls for comment.

________________________________________

Questions? Comments? Email us atNetNet@cnbc.com

Follow John on Twitter @ twitter.com/Carney

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC