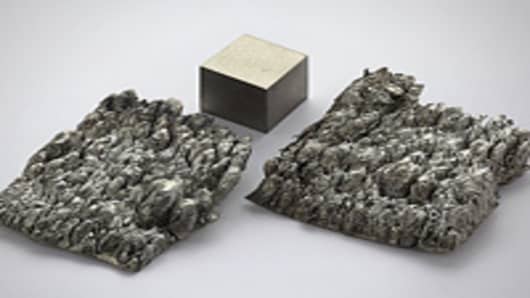

Once again China has stunned the world by increasing export restrictions on rare earths contained in iron alloys. The new ruling expands the export quotas to alloys that contain 10% or more rare earth elements.

On the surface China has claimed it is attempting to clean up the illegal mining of rare earths and reduce overcapacity. Thursday's move does nothing to accomplish this goal, however, it does tell me is that real demand for rare earths in China is increasing. Additionally China is using rare earths as a political bargaining chip.

Just the mention of rare earths can elicit a both elation and groans among investors - sometimes from the same person! Perhaps its the volatility that makes many scoff and declare 'rare earths are in a bubble' or' they are just a fad'.

I welcome this sentiment, primarily because it is misplaced and has created tremendous investment opportunities over the last 8 months. In my view, the ubiquitous industrial uses for rare earth elements makes them vastly more valuable than gold and silver. It certainly makes them more valuable than a homemade soda making machine...I'm looking at you Sodastream!

The ability to value a company like Molycorp is complicated not only by the whims of the Chinese government but also by the fact that the underlying commodity has skyrocketed in the last month.

Herein, lies the opportunity. Traditional valuation techniques are not appropriate; in my view Molycorp should be treated more like a commodity where the valuation is dependent upon the underlying supply and demand. While daily supply/demand figures are hard to come by we can use the Shanghai daily prices of rare earths.

This technique has worked very well since March as MCP has tightly tracked the price of Lanthanum. However, the recent US market sell-off caused MCP to decline while rare earth prices continued to to hit the stratosphere. In my view, the demand for rare earths is a sustainable trend that will last for years, not weeks, therefore the current price of MCP makes an excellent entry.

Since the move was technically driven, not a fundamental change, it makes sense to use the technicals to define our entry and exit. Molycorp has retraced 61.8% of the March-April rally and now appears to be bottoming on increasing volume.

If we use the March 17th low of $55.82 as the correction base for the next move, we can then use the technicals to derive a price target.

Typically new rallies travel between 100% and 161% of the previous rally - measured from the correction base. Using this rule of thumb we derive a technical price-target range between $95 and $118. Additonally, the last rally lasted for 6 weeks, thus I would expect the next rally to last at least as long.

To sum up...if you think iPads, iPhones, electric car batteries, wind energy, water treatment, and guided missiles are NOT in a bubble, then the trade is to stay long MCP.

* Brian Kelly is founder Brian Kelly Capital

For the best market insight, catch 'Fast Money' each night at 5pm ET, and the ‘Halftime Report’ each afternoon at 12:30 ET on CNBC.

______________________________________________________

Got something to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap! If you'd prefer to make a comment, but not have it published on our Web site, send your message to fastmoney@cnbc.com.

Trader disclosure: On May 19, 2011, the following stocks and commodities mentioned or intended to be mentioned on CNBC’s "Fast Money" were owned by the "Fast Money" traders;

Brian Kelly

Accounts Managed By Brian Kelly Capital own (MCP) calls

Accounts Managed By Brian Kelly Capital own (BHP)

Accounts Managed By Brian Kelly Capital own Australia Dollars

Accounts Managed By Brian Kelly Capital own (TLT) calls

Accounts Managed By Brian Kelly Capital own (EBAY)

Accounts Managed By Brian Kelly Capital own (SLV) calls

Accounts Managed By Brian Kelly Capital are short yen