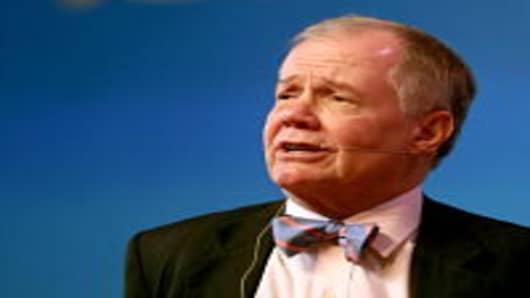

Jim Rogers always says his timing is terrible, particularly when it comes to the markets – though it's hard to believe that of such a successful and inveterate investor. Still, he admits he was completely wrong about the decision that now dominates his life, to have kids.

“I thought children were a terrible waste of time, energy, money – I felt sorry for my friends who had children,” he says. “I thought it was something I would never do. I was terribly wrong. They are so much fun.”

Having become a father at the age of 60, Rogers, now 68, is trying to devote himself to his family. They famously uprooted from New York and moved to Singapore so daughters Happy (full name Hilton Augusta, about to turn 8) and Beeland (known as Baby Bee, now 3) can learn Mandarin.

Rogers is becoming a familiar sight to his neighbors bicycling his two daughters to school, and picking them up each afternoon, eight kilometers in four round trips. Bar travel for his many speaking engagements around the world, he does it each day.

“I came to all this late in life and I do have the time and the energy and the money that I can devote a lot of time to them, so I try to,” Rogers says. He’s out of breath as we speak, gasping a little as he rides his exercise bike, which he tackles daily for an hour or two if he is at home.

That’s fairly typical of his behavior, his wife, Paige Parker, says. “He is an unbelievable multi-tasker,” she says. “There are rare minutes where he does not have something that he needs to do. I don’t think you become successful unless you’re an over-achiever, and I think Jim is.”

James Beeland Rogers Jr. was born in Maryland but grew up in the small town of Demopolis, Ala., where his father, James Beeland Rogers, was the plant manager of a chemicals factory. As a young man, he recalls telling people he was going to drive around the world – without really knowing what that meant.

He eventually made good on his pledge, driving first a motorbike around the world from 1990 to 1992, a journey he chronicled in his book “Investment Biker.” He then tackled the trip again by car with Parker, driving a specially adapted Mercedes around the globe between 1999 and 2002, and writing about it in “Adventure Capitalist,” one of his five books.

En route, Rogers and Parker got married on January 1, 2000, in Henley-on-Thames, where as an Oxford student and rowing blue he had won the Thames Cup. A degree at Oxford followed one at Yale, and then led him to Wall Street.

After joining the firm of Arnhold and S. Bleichröder, he then split off with George Soros to form the Quantum Fund in 1973. New brokerage regulations required them to be independent if they wanted to charge clients a percentage of assets as a management fee.

The fund, one of the first handful of hedge funds, was wildly successful. But he left in 1980 to manage his own money. “I adored the markets, and was totally consumed and passionate about the investment world,” he says. “I could hardly wait to wake up each morning and get going.”

Though now known primarily for his bullishness about commodities and China, he has had other investment passions. He was a champion of emerging markets in the 1980s, from Austria to Argentina to the Ivory Coast.

It was his trips around the world that encouraged him that the bear market in commodities was about to end after two decades of a slump. “Very few people had any interest in them,” he says, with next to no investment and new capacity. “I knew what was happening in Asia. So with supply and duress, there had to be a bull market coming. And lo and behold!”

Rogers also timed the U.S. property market almost perfectly convinced a bubble had built there. He and Parker sold their home on Riverside Drive, a deal for $16 million that closed in December 2007. He had bought the home in January 1977 for $106,000, at a time the city teetered on bankruptcy and was at its nadir. “They were giving things away,” he recalls.

Now, the couple is looking to buy a home in Singapore, though they rent for the time being. Feverish price rises in Singapore make a correction likely, he believes. “I am looking for a house but I'm not looking too hard because I expect prices to come down,” he says.

China’s property market is in a bubble in coastal cities, he believes. But he distinguishes that price bubble from the devastating credit bubble that developed in U.S. property.

“You have a price bubble that will end someday — probably this year or next if the Chinese government keeps up their nerve,” he says. “But it’s not going to destroy China. Real estate developers may lose money. Banks may lose money on mortgages. But the whole economy doesn’t revolve around it.”

The marriage to Parker is his third, Rogers having been married in 1966 to Lois Biener and in 1974 to Jennifer Skolnick. Each former marriage lasted three years. “The first was youthful foolishness. The second was something I should not have done,” he says.

Thank goodness he didn’t have children at that age, he says now. He threw himself into his career at the expense of most of everything else, and any kids then would certainly have been collateral damage.

“I was driven and loved what I was doing and working very hard trying to be successful,” he says. “Neither woman was interested in my ambitions or how hard I thought I need to work. Fortunately, we were aware enough to know it.”

Rogers says he has slowed down after having children – a point contested by his wife. Has his pace slowed in parenthood? “Absolutely not,” Parker, now 42, says with a chuckle. “He is a high-strung Type A who likes to get it done.”

The couple met in 1996, when Rogers gave an address in Charlotte, N.C., at Queen’s College, where Parker was working for the college president, Billy Wireman. Wireman was a Sinophile, and encouraged her to read Rogers’ book and attend his talk. Since they met, “I feel like he’s been going fast forward,” she says. “Maybe he went faster before.”

Rogers says he has not had any clients for 31 years, and manages purely his own money. An index he created, the Rogers International Commodities Index, is managed by and licensed to third-parties. He’s cagey about the amount he manages.

“I grew up in a family where you don’t talk about how much things cost, how much money you have, how much you earn and so on,” he says. “My father would roll over in his grave if I talked about things like that.”

But he will share strategy. Rogers says he is currently long on commodities and currencies, having started to buy the U.S. dollar in the form of Treasury bills in November 2009. He also favors the yen, euro, Swiss franc, Canadian dollar and Australian dollar.

His favorite currency play, though, is the Chinese yuan. Whenever he speaks in China, he requests that his fee be paid in the currency, and he converts whatever currency he is allowed – 20,000 renminbi per day when he’s in China – into yuan.

He is short on emerging markets and U.S. information/technology companies, via exchange-traded funds, though he declines to identify the products themselves. Though bullish on China, he is negative on India and smaller emerging markets such as Indonesia. Those markets and tech stocks have been overexploited, he believes.

Does he have a target price for gold? “No, none whatsoever,” he says. “I hope I’m smart enough to own commodities until the bull market ends. Nearly all bull markets end in bubbles, and I hope I’m smart enough to recognize the signs.”

He believes the current correction in commodities is a short-term blip in their upward run. That may have years to continue, just as the 1987 crash was a brief respite in a decade-long bull run for stocks.

“What will probably happen is that I will sell my commodities, and they’ll double again, then I’ll sell them short, then they’ll double again because all bubbles go up farther than you expect,” he says. “And then, if I don't get wiped out, they’ll fall and I’ll make some money.”

Rogers is now considering writing an autobiography at the request of his agent and publishers – though he’s unsure whether he’ll do it. “I’m not convinced the world needs or wants an autobiography of me,” he says.

He does not follow the minute movements of the markets and prefers to focus on the bigger picture. His heavy speaking schedule keeps him traveling much of the time. When in Singapore, he concentrates on home life.

“I’m trying to devote as much time to my family and children as I can,” he says. “Especially since I became a parent fairly late, I want to miss as little as possible.”