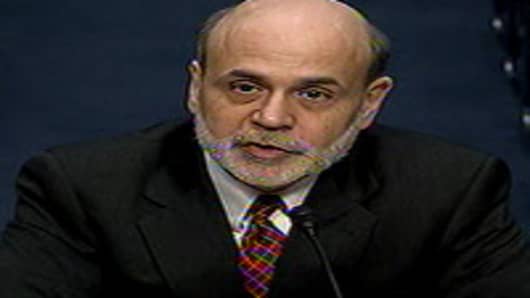

Fed Chairman Ben Bernanke is in the hot seat before a Congressional panel Wednesday, as markets keep a watchful eye on headlines from Europe and debt ceiling talks in Washington.

Bernanke is likely to be asked about both topics by the House Financial Services Committee at the semiannual economic hearing. He should also face questions about the state of the economy at the 10 a.m. hearing, and whether he sees the current soft patch as temporary or something more worrisome. He also will likely be asked about monetary policy and whether the Fed would entertain further easing, after minutes of the Fed's last meeting, released Tuesday, showed members discussed the potential for further easing.

"This talk about QE3 (a third round of quantitative easing), based on the minutes, is very much overwrought," said Pierpont Securities chief economist Stephen Stanley. "It was a classic 'on the one hand, on the other hand' passage. It seems to be crafted very carefully to be even handed," he said. The Fed ended QE2, a program to buy $600 billion in Treasury securities just after that June 22 meeting, and it has signaled a high threshold for any further easing.

Stanley said Bernanke will likely dodge questions on taxation and deficit reduction, topics about which Republicans and Democrats disagree. "I think he'll avoid commenting on any special programs. He very much was on record arguing we should have a clean debt ceiling release," Stanley said. Congress is working towards an agreement ahead of the Aug. 2 deadline to raise the U.S. debt ceiling.

Bernanke is expected to continue to support the view that the economy will improve in the second half, but there has been one major turn in economic news that may cause Bernanke to respond, Stanley said. That is the ugly jobs report from Friday, which revealed anemic job growth of just 18,000 jobs in June, well below most economists' expectations.

"That number was very bad and trumps anything else we have seen. There may be some additional concerns about the labor market," he said.

European Contagion

Financial markets have been fixated this week on the idea that European sovereign credit risk is spreading, and now has encircled Italy, the biggest nation to date to be besieged by fiscal worries.

Italy's bond yields have been soaring though they came off their highs, as speculation circulated Tuesday that the European Central Bank was buying peripheral sovereign debt Tuesday. The yield on Italy's 10-year bond temporarily rose above 6 percent.

U.S. stocks started lower, moved higher and moved lower again late in the session after Moody's downgraded Ireland's debt just before the closing bell Tuesday. The Dow was down 58 points, or nearly a half percent at 12,446, and the S&P 500was off 5 at 1313.64. Treasury prices moved higher in part in a flight-to-safety trade, and yields moved lower. The 10-year was around 2.9 in late trading.

Kevin Ferry of Cronus Futures Management does not see the European sovereign story as the main catalyst for low U.S. rates. "You really have a situation where the movement in Treasury yields from June to July in the United States shows a complete deterioration of the growth prospect. That's what people have to focus on. It's not the debt ceiling. It's not the peripherals. Growth is the key issue," he said.

Meanwhile, Italian Prime Minister Silvio Berlusconi Tuesday attempted to assure markets that Italy was working on a plan to accelerate debt reduction and balance the budget by 2014. Economy Minister Giulio Tremonti left a euro zone finance ministers meeting early to return to Rome to work toward adoption of the 40 billion euro fiscal reform package, which will be voted on by the cabinet Thursday.

Some analysts believe Italy has unfairly become a focal point for short sellers and speculators. Yet, markets remain jittery because Italy is much larger than other troubled European countries that ultimately ended up needing help. Political tensions between the prime minister and Tremonti, who Berlusconi accused of not being a 'team player,' have added to market anxieties.

"It's investors who have made money betting on one crisis after another. We think the problems will eventually be in Spain, but I think people seized on some of the political issues in Italy, and they decided to leap frog Spain and go right to Italy," said Robert Sinche, global currency strategist with RBS. "I think it's unfortunate because the policy leadership in Europe allows investors to make money off of assuming they're not coming to the fore in time. They may eventually, but in the meantime, people have moved in and taken their pound of flesh from the market."

The euro has weakened to below 1.40, on the sovereign concerns but also ahead of the results of stress tests, to be released Friday on 91 European financial institutions. "... While governments can deal with financing needs in reasonable amounts ... it's if the banking system really became under stress that you have bigger problems. If there was a wholesale run on the banks in Ireland or Greece or Portugal, that's the mechanism that would take it from being a sovereign issue to a broader issue. That's where the stress tests are an issue, if it does create deposit withdrawals or concern about the banking system," said Sinche.

Sinche expects the euro to continue to weaken and his year-end target is 1.30. That call includes the view that the dollar will begin to strengthen, as the U.S. economy picks up speed, but so far it's been more of a euro in decline story. "It's in play. It's been kind of a one-sided movement in euro/dollar. We expect the other side will come into range in the next couple of weeks," he said.

European leaders hold an emergency summit Friday, after finance ministers said for the first time that a Greek default may be needed, according to Reuters. Besides Bernanke's testimony, traders are watching the 1 p.m. auction of $21 billion in reopened 10-year Treasury notes. There is also June import prices data at 8:30 a.m. and the June report on the federal budget at 2 p.m. Earnings are expected from Marriott and Yum Brands after the bell.

Questions? Comments? Email us at marketinsider@cnbc.com