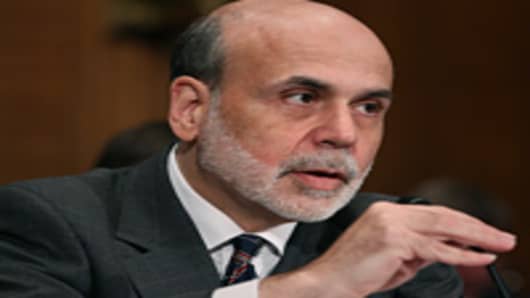

Oh, man. If this is the Benjamin's idea of monetary policy help, imagine if he wanted to screw things up. But I shouldn't blame Ben.

In fact, I'm not.

All he had was B-B's left in the ammo dump. He had fired the big guns early on and they didn't do any good. The Navy pounded Iwo Jima for days and the island was still a killing field. Same with Omaha Beach. There are some things only face to face combat can dig out.

The face to face in this case is companies (with over $2 trillion in domestic cash and almost as much overseas) finally seeing the white's of the enemy's eyes. The enemy is Washington and the inability of both parties to come to grips with the reality of our situation. Tax policy is hopelessly chaotic as it the potential cost of health care. I am not a big fan of FDR's New Deal, but I am a huge fan of FDR. "All we need to fear..." shows leadership at its finest. We have no leadership and why, if you were running a business, would you commit to anything without knowing what the rules of engagement were. We don't have to like the rules, we just have to know what they are.

The Fed'sannouncement of the Twistwas, with a few little twists, as expected. Rates went immediately lower, so you could say it was "Mission Accomplished." But I won't since the last Texan in the White House so mis-used the expression. Imagine a world where the 10 year bond yield is 1.5% and the 30 year 2.5%. They are on the way to those levels. Instead of stirring up animal spirits, ultra-low rates seem to be convincing people that the worst is yet to come. Ben gave a dismal, if honest, assessment of the economy and the stock market tanked.

But it was more than Ben. About the same time the Fed was Fedding, Europe took another swoon and the dollar rallied. Rumors abound about the next phase of the crisis over there. But, it's clear to all except the Europeans, who just won't admit it, the banks need to be recapitalized. Greece needs to default, and Germany has to pay for it. It is what it is, wishing otherwise will not make it so (Is that Shakespeare?)

China's Purchasing Manager's Index slipped to 49.4, semi-contractionary. Europe's did the same. The preliminary (flash) European services PMI was 49.1, and the expectation was for 51. The preliminary manufacturing index was 48.4, and the composite registered 49.2. Dismal, but not a disaster by any means.

Good news around the corner is Congress can't agree on a spending bill to keep themselves in session. We could get an enforced holiday from these yahoos. And Barney Frank evidently is tight with the on-line poker guys. His office said they are putting contributions from those dudes aside. Did you see their pictures yesterday? Sorry, could I have my saucer of milk now. I am done being catty.

And, oh yeah, the stock market. We have been guessing a trading range with 1120 on the downside. Gee, here we are. Figure 1096-1100 since that would be a 20% fall from the recent high (bear market definition) and then a bounce. A bounce could be a fair size one. But I worry that we might need to go to 1020 which would be a full 50% retracement of the rally that started in March, 2009 from 666. Let's dig in and pray for a bounce. And soon.

Vincent Farrell, Jr. is chief investment officer at Ticonderoga Securities and a regular contributor to CNBC.