It was a day for politicians on both sides of the aisle to beat the drum on taxes.

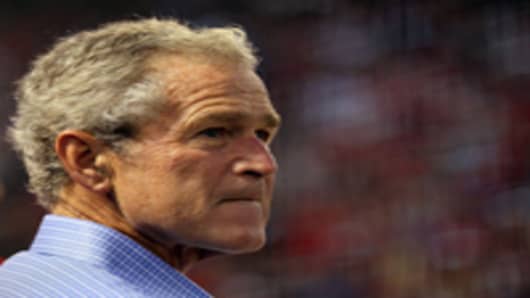

First, there was former president George W. Bush leading the conservative charge. He was at the New York Historical Society in Manhattan this morning headlining the George W. Bush Presidential Center’s “Tax Policies for 4 Percent Growth” conference. The conference is designed to push for more growth by cutting taxes.

“Four percent growth in the private sector is ambitious, we recognize that, but it is doable,” he told the audience. “Seventy percent of all new jobs in the country are created by small business. If you raise taxes, you’re doing it on the backs of the job creators.”

Meanwhile, President Obama was in Florida, advocating “The Buffett Tax Rule” and arguing that Americans earning at least $1 million in salary or investments should pay at least 30 percent of their income in taxes.

According to the non-partisan Tax Policy Center, just 1 percent of the 34 million American households reporting business income on their taxes earn more than a million dollars a year.

Bush has made only a few public appearances since leaving office in 2009, as he has tried to avoid the limelight. “I don’t miss the presidency,” he told the audience, “but I’d forgotten how inconvenient it is stopping at red lights.”

On the subject of taxes, he tried to keep it light, as well, when he quipped: “I wish they weren’t called the Bush tax cuts. If they had someone else’s name on them they’d be less likely to be raised.”

But tax cuts are serious business, and Bush introduced New Jersey Governor Chris Christie, using the Garden State as an example of how taxes need to be cut to spur growth. Governor Christie said that “you can’t start pro-growth policies until you get your house in order.”

Christie cut spending 9 percent across all state government agencies after he inherited what he called a budget crisis. “New Jersey is now heading in the right direction,” said Christie. “If we can make these difficult cuts and compromises in New Jersey you can do it anywhere, most importantly in Washington, D.C.”

While the politicans were making their arguments, small business ownerswere making theirs. Today, nine business organizations sent a letter to the U.S. Senate disputing the argument that a “Buffett Tax” would hurt small business owners. The letter — signed by representatives of such organizations as the American Sustainable Business Council, Main Street Alliance and Business for Shared Prosperity — said 57 percent of small business owners support the “Buffett Tax.”