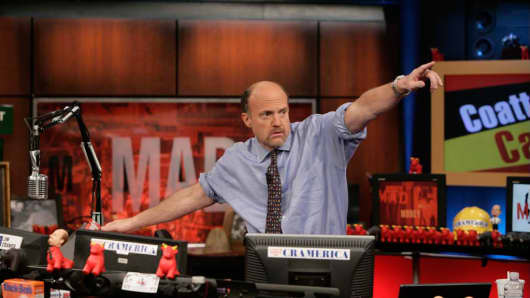

U.S. stocks rallied Tuesday on the belief that the euro will remain intact for some time after Greece voted in favor of austerity and was rewarded by the European Union with easier credit terms to help grow its economy, said Jim Cramer on CNBC’s “Mad Money.”

In Cramer’s opinion, that hint of growth was all the market needed to push higher. To him, the gains show that while Europe’s debt crisis deserves attention, it might not be “so awful” after all. Cramer thinks the region can still “pull out of its tailspin before a fiery conflagration ensues,” especially if it shows more signs of possible growth. To support his thinking, he noted that earnings reports from several U.S. companies suggest that Europe’s economy is actually hanging in there.

Either way, Cramer said Tuesday’s market was lifted by a host of positive news. He detailed a few highlights.

To start, FedExrebounded even after the package delivery company handed in current quarter and full-year guidance that missed estimates. FedEx’s stock would typically fall 3 points on such news, Cramer said, but it actually rallied.

Meanwhile, Cramer noted several industrial names caught downgrades. A major firm had negative comments about engine maker Cummins because of weak worldwide growth, he said. The stock would typically plummet several points on the news, but Cramer said it managed to push higher.

Elsewhere in the market, Cramer said a weak U.S. dollar sent the price of oil up. That, coupled with the possibility that China may consume more energy, may have put a bottom in oil, he added. In turn, many oil and gas-related stocks could rally.

In the technology space, Oracle rallied after the tech giant posted stronger-than-expected quarterly profit Monday afternoon, releasing the results three days ahead of schedule. CLSA raised its rating on the firm to "outperform" from "underperform." Of course, few noticed the news surrounding Oracle because they were busy fretting about Europe, Cramer said.

So what’s the bottom line?

“You get Europe back on any growth path whatsoever, you are going to see a major rally that will take us far higher than anyone believes,” Cramer said, adding that while Europe has favored austerity instead of other policies that might promote growth, it might not be too late. “They may be changing their tune.”

—CNBC.com contributed to this report

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the Mad Money website? madcap@cnbc.com