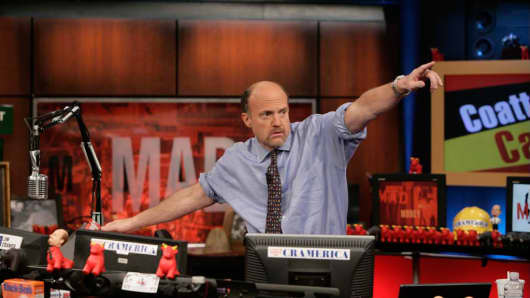

A correction is “one of the most dreaded and poorly understood terms in the business,” said Jim Cramer on CNBC's "Mad Money." It’s a complete and total euphemism, really. Corrections can hit stock prices for as much as 10 percent at a time and make you want to never invest again.

But here’s what you need to remember about them: They always follow a run that took us up too far too fast, making them very hard to predict. You will most likely never seem them coming, so there’s no point in beating yourself up for being caught off-guard.

(RELATED: Cramer's Top Dividend Stocks)

“Selloffs are a natural feature of the stock-market landscape,” Cramer said. “We don’t have to like them, but we do need to acknowledge that they will happen no matter what.”

One final piece of Wall Street gibberish that Cramer wanted viewers to understand is the idea of “execution.” This is the ability of a CEO to follow through with his or her plans for the company.

There are many ways for management to screw up execution — unwieldy acquisitions, failed new-product launches, bad cost controls — which is why Cramer actively seeks out companies with strong leaders. Think Mickey Drexler of or, of course, former Apple CEO Steve Jobs.

And he thinks investors should be willing to pay up for these top-notch managers, too. Because a good management team is less likely to make mistakes and more likely to thrive in spite of problems in the industry.

“Best of breed stocks are almost always more expensive than their cheaper competitors,” Cramer said, but they’re “worth the price.”

(Written by Tom Brennan; Edited by Drew Sandholm)

When this story was published, Cramer’s charitable trust owned Apple.

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the Mad Money website? madcap@cnbc.com