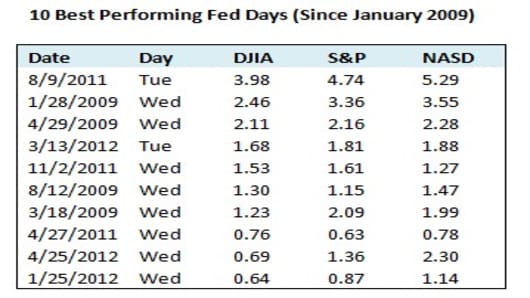

As investors look ahead to the Federal Reserve's policy decision on Thursday, CNBC analyzed the market performance on Fed days.

Since the onset of the financial crisis in December 2008, the Fed has been running a Zero Interest Rate Policy (ZIRP), along with two rounds ofquantitative easing. In the aftermath of that turbulent period, stocks have typically done well during Fed policy decision days, with all three major U.S. indexes posting a positive return 66 percent of the time.

The real market cheers, however, seem to take place a month after the Fed meets. In that time span, the S&P 500 has averaged a gain of 1.45 percent, with positive returns coming 76 percent of the time. (Read more: Market Savior? Stocks Might Be 50% Lower Without Fed)

The Dow averaged a gain of 1.2 percent, up 72 percent of the time, while the Nasdaq had the largest average increase of the three, up 2 percent, and positive 69 percent of the time.

Fed Day By the Numbers:

- Since President Obama took office in January 2009, there have been 29 Fed announcements. September 13, 2012 will be the 30th;

- The Dow has been positive 66% of the time with average gain of 0.41%, S&P and Nasdaq have been positive 66% of the time with average gain of 0.53% and 0.62% respectively;

- The biggest one day gain occurred on 8/09/2011 when the Dow gained +3.98%, S&P gained 4.74% and Nasdaq gained +5.30%;

- The largest one day loss occurred on 9/21/2011 when the Dow lost -2.49%, S&P lost -2.94% and Nasdaq -2%. This was also the day the Fed announced ‘Operation Twist’ (buying long term treasuries and selling short term ones);

- During the last two Fed days – 6/20/2012 and 8/1/2012, the indexes have closed negative, except for the Nasdaq, which closed up a slim +0.02% on 6/20/2012.

Fed Day & the Market Stats

One Day after the Fed:

- The Dow has been positive only 38% of the time, with average loss of -0.50%. Meanwhile, the S&P and Nasdaq has been positive only 35% and 45% of the time, respectively, with respective average losses of -0.57% and -0.50%;

- Biggest one day gain after Fed day occurred on 11/05/2009, when the Dow gained 2.08%, S&P gained 2.14% and Nasdaq gained 2.42%;

- Biggest one day loss occurred on 8/10/2011 when the Dow lost -4.62%, S&P lost -4.42% and Nasdaq lost -4.09% (This was also the day that followed the biggest one day Fed gain since January 2009);

- During the last two ‘day after Fed day’ – 6/21/2012 and 8/2/2012, all three indexes have on average closed negative roughly -1.4%.

One Week after Fed Day

- The Dow has been positive only 62% of the time with an average gain of +0.36%, while the S&P and Nasdaq has been positive 59% and 62% of the time, respectively, with corresponding average gains of +0.33% and +0.37%;

- The biggest one week gain after Fed day occurred in the week of 11/04/2009 when the Dow gained +5%, S&P gained +4.97%, and Nasdaq gained +5.42%;

- The largest one week loss occurred in the week of 6/23/2010 when The Dow lost -5.09%, S&P dropped -5.62%, and Nasdaq shed -6.43%.

One Month after Fed Day

- The Dow has been positive a whopping 72% of the time, with average gain of 1.20%. The S&P and Nasdaq has been positive 76% and 69% of the time, respectively, with average respective gains of +1.45% and +1.97%;

- The biggest one month gain after Fed day occurred in the month following 6/24/2009 when the Dow gained +9.5%. Meanwhile, the S&P and Nasdaq had their biggest month following the 3/18/2009 announcement with gains of 9.5% and 12.2% respectively;

- The largest one month loss occurred in the month following 1/28/2009 announcement when The Dow lost -15.67%, S&P lost -15.90% and Nasdaq lost -11.98%.