"In other words, don't confuse being a good investor with the idiotic ideology of buy and hold, or as I skeptically dub it, 'Buy and forget,'" he said. "Buy and hold has been the conventional wisdom for decades, and this one bad idea has lost people more money than the last two financial crises combined."

A long-term plan doesn't mean investors should take loss after loss in the short-term.

"Losses are losses, realized or otherwise," he said. "And the notion of being in something for the long-term doesn't justify owning damaged goods, the stocks of companies that are in bad shape, in the misguided hope that they'll eventually recover."

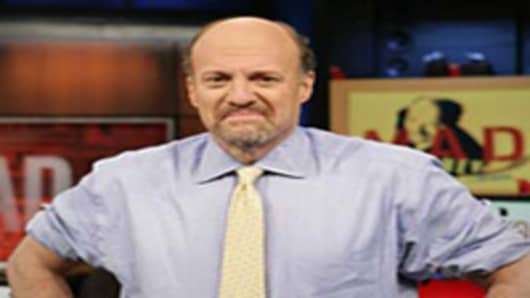

Cramer reiterated the idea that investors should keep track of their investments and do the in-depth research.

"Hey, it's your money," he said. "Invest the time in it."

Cramer pointed out that sometimes companies experience a secular decline from which they never recover, in which case investors can't wait for a turnaround.

"Just ask the people who rode Research In Motion or Nokia or RadioShack or Supervalu all the way down," he said.

If anything, Cramer added, being in the stock market for the long-term requires more diligence and patience than if you're in them for the short-term.

"To paraphrase that fabulous poetic amateur investor and world-renowned beauty, Gertrude Stein: A loss is a loss is a loss, unrealized or otherwise, and don't you forget it," he said.

Call Cramer: 1-800-743-CNBC Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com