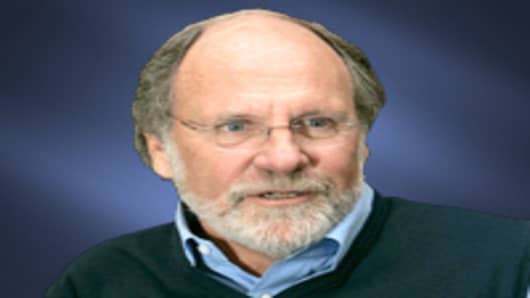

The best explanation of the insanity of the suicidal investment strategy followed by Jon Corzine and MF Global comes from Brad DeLong.

DeLong explains that MF Global's position in southern European bonds could only work in one of four possible outcomes:

1. If the market tolerates MF Global's risk and the bonds don't default, MF Global wins.

2. If the market doesn't tolerate MF Global's risk, it doesn't matter if the bonds pay off because MF Global will be broke.

3. If the market tolerates the risk, and the bonds default, MF Global goes broke.

4. If the market doesn't tolerate the risk and the bonds don't pay off, MF Global is broke and broker.

"MF Global is thus making two directional bets: the bet that southern Europe will pay off, and the bet that the market will remain tolerant of southern Europe risk in the meantime," Delong writes. "If either of those bets fails, MF Global is toast."

More:

MF Global's bet is attractive to: (a) rogue traders (and rogue CEOs) speculating with other people's money; (b) those who are highly confident in their ability to switch from highly leveraged speculators to patient well-capitalized investors in fundamentals if necessary; and (c) those who don't believe that there are shocks to risk tolerance that are orthogonal to shocks to fundamentals.

In other words, Corzine was acting like a typical rogue trader or an egomaniac.

Questions? Comments? Email us atNetNet@cnbc.com

Follow John on Twitter @ twitter.com/Carney

Follow NetNet on Twitter @ twitter.com/CNBCnetnet

Facebook us @ www.facebook.com/NetNetCNBC