Lost amid the government shutdown, the United States last week marked a dubious milestone: Four decades have passed since the Organization of the Petroleum Exporting Countries, also known as OPEC, hobbled the the nation's economy with an embargo on oil exports.

It's an anniversary most Americans would prefer to forget. Today, thanks to a massive surge of domestic production—which according to some estimates is pushing U.S. output past even that of Saudi Arabia—most observers probably assume that turmoil abroad exerts far less pull on U.S. energy prices than it once did.

A consensus also is forming that America is on its way to becoming a global energy powerhouse, driven in part by the shale boom. But some experts argue that the U.S. is still vulnerable to an external energy shock.

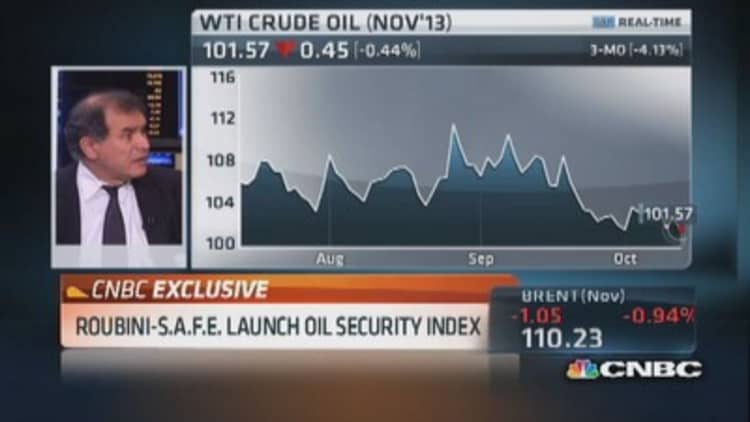

Among the 13 major economies considered most exposed to an oil shock, "the U.S. ranks somewhere in the middle," Nouriel "Dr. Doom" Roubini told CNBC in an interview this week, discussing a new, proprietary index rating nations' oil security.

"The security has gotten better over the last few years, but there are at least two aspects of the U.S. that are a concern," Roubini said. The U.S. still consumes more energy per capita than any other country except Saudi Arabia, and falls short in using energy efficiently, he said.

Those pitfalls resonate in the U.S., where 97 percent of automobiles run on petroleum-based fuel. Energy-efficient vehicles that run on alternative fuels remain a tough sell with most Americans.

This week, the International Energy Agency projected that the U.S. would shave its oil imports in half by 2020—feeding the already optimistic predictions of domestic energy independence. Such a development would appear to contradict the idea that the world's largest energy consumer could still take a major economic hit from spiking oil prices or more turbulence in the Middle East.

Still paying more at the pump

Yet Anne Korin, co-director of the Institute for the Analysis of Global Security and the co-author of a new report on energy independence, believes people are misinterpreting the concept of secure domestic energy. In her view, the emphasis on imports is a function of the lingering "trauma" of the 1973 embargo and misses the larger point.

"Security means stability and affordability of oil," Korin said in an interview. "We've done well on the stability but not on the affordability side of the ledger. … We're still paying more at the pump."

(Read more: US gas prices slide as summer's end, supply brings relief)

She said the "virtual monopoly" oil enjoys over U.S. motor vehicles means gasoline prices won't dip appreciably—especially because distillates, including diesel fuel, are still based on the price of Brent, the international oil benchmark.

That means that, despite America's best-laid plans, the country could still find itself squeezed by an unexpected tantrum by OPEC, or deeper instability in places like Libya, Egypt and Iraq.

"The fact is you have this cartel that sits on three-fourths of conventional oil reserves," Korin said, arguing that OPEC is still stingy with its oil production as the U.S. ramps up its own.

The oil cartel, which supplies more than a third of the world's oil, currently maintains an output target of 30 million barrels a day. That has kept oil prices comfortably near $100 a barrel for much of the year and helped keep the average price of gasoline above $3 a gallon.

"When we drill more, they can simply drill less," Korin said. "The fact is they're not producing to the level that they potentially could, and that's why prices are so high."

—By CNBC's Javier E. David