Now that the largest corporate bankruptcy in Latin American history is official, perceptions of whether it's handled fairly could have wide ramifications, helping or hindering investor interest in Brazil, South America's largest economy.

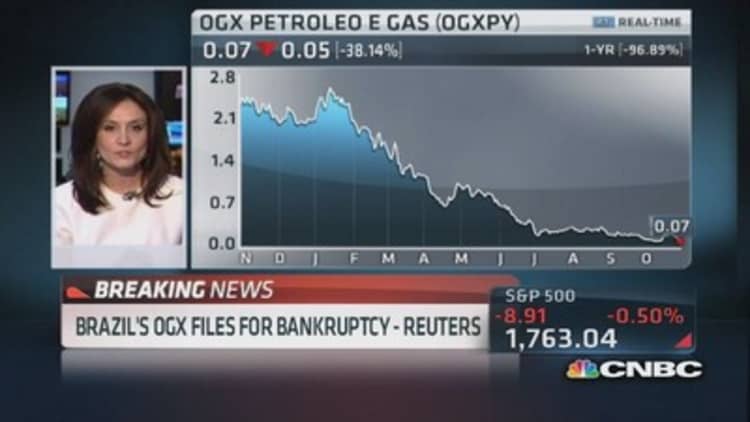

Eike Batista's energy company, OGX filed for protection from creditors Wednesday, creating a major test for Brazilian courts: The country's bankruptcy and restructuring regimes are relatively new—they became law only in 2005—and investors will watch to see how quickly the process moves and whether creditors are treated fairly.

As a source close to the OGX situation put it, "This is not a well-tested process."

Officially, OGX has filed for something called "judicial reorganization"—the closest Brazilian equivalent to U.S-style Chapter 11. While in the United States "bankruptcy" is a broad, more encompassing term, in Brazil, bankruptcy speaks exclusively to liquidation.

The judicial reorganization law was intended to fix major issues in the prior process, which was seen as slow and cumbersome, and to rid it of its more creditor-unfriendly aspects. Brazil's new law provides for things long considered a matter of course in the U.S.: debt haircuts, restructured interest rates, grace periods, equity sales, debt-for-equity swaps, and debtor-in-possession financing and superpriority in the event of a subsequent filing.

Paulo Rabello de Castro, head of the Brazilian rating agency SR, said that things have improved in the eight years since the law was enacted because people involved in its implementation have "acquired some mileage."

Still, one key issue investors and creditors will be watching is whether OGX's management works in the best interests of the company's creditors—and what will the judge do if it doesn't?

(Read more: Would the Keystone pipeline affect gas prices? No, not really)

Eike Batista controls other companies that are not in bankruptcy and yet are also creditors to OGX.

Sources who spoke with CNBC raised questions—for example, could Batista encourage OGX management to take actions that are in the interest of OSX, his shipping company, to which OGX owes money?

And if the creditors or the judge perceive that management is not acting in the best interest of OGX and its creditors, will the judge move to replace them and find interim management? In the past, "management friction" has proved a problem in Brazil, Rabello de Castro said.

OGX declined to comment for this report.

Another point is the degree of control that equity holders can impose. In U.S. bankruptcy proceedings, equity holders generally have zero control and expect nothing more. In Brazil, and Latin America in general, equity holders have far more say.

(Read more: Made-in-USA shipbuilding finds an unlikely ally—in the energy boom)

"In Brazil, the recent Rede Energia and Celpa proceedings provide evidence of the extent to which equity that is out of the money can still control the restructuring process. In both of these cases, the controlling shareholder was able to handpick the buyer for the defaulted business and control the restructuring process, with the tacit or explicit support of the government," says an article from Pratt's Journal of Bankruptcy Law written by Richard Cooper, Joel Moss and Adam Brenneman.

Cooper, of law firm Cleary Gottlieb, is advising some of OGX's major creditors. He declined to comment for this article.

—By CNBC's Michelle Caruso-Cabrera. Follow her @MCaruso_Cabrera.