It is yet another step in the evolution of the single-family rental market: a new lending platform by one of the biggest names in the trade, Blackstone Group. After investing close to $7 billion in rental properties through its Invitation Homes unit, Blackstone is offering cash to smaller investors wanting to get into the game. The firm is in the closing process on the first deals.

"The market for financing for small and medium-sized borrowers in the single-family rental space is underserved—they don't have access to good capital now," said John Beacham, president of Blackstone's B2R, a buy-to-rent lending platform.

Blackstone is originating loans of $500,000 to $50 million to small and midsize investors buying a minimum of five single-family rental properties. Each home must be worth at least $50,000, and Blackstone will do a lot of homework, using local appraisers to determine if the property's cash flow covers the debt service.

"We underwrite our loans on a very conservative basis ... like a commercial real estate loan," Beacham said, adding that borrowers should have 25 percent to 30 percent skin in the game on each house. "We confirm the lease and the rent on the lease. We think that by underwriting this like a multifamily building, on pools of houses with more sophisticated borrowers, we have a pretty conservative loan product."

Large institutional investors such as Blackstone, Colony Capital and American Homes 4 Rent have flooded into the market over the past three years, buying up thousands of distressed properties, remodeling and putting them up for rent. As housing prices gain significantly—as they have in 2013—some have claimed that the trade is falling out of favor.

Other investors disagree and see no slowing in rental demand.

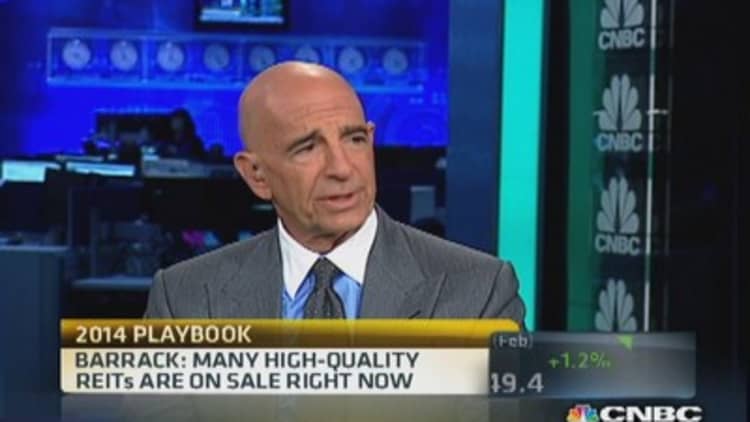

"I think [Blackstone's move] is brilliant," Tom Barrack, CEO of Colony Capital, said on CNBC's "Fast Money Halftime Report."

"The natural place to go, if you have a great structure like Blackstone has … is, we're going to lend into that environment, we're going to give them the services and the products we have, and we'll extend this asset class into a business, which is everybody's goal," he said.

Though large investors have poured $14 billion-plus into the single-family rental market recently, they represent only about 2 percent of property owners. It is still largely the purview of "mom and pop" landlords. The trouble is that smaller investors have had limited borrowing ability. Fannie Mae and Freddie Mac will give a maximum of 10 mortgages to one investor.

"We are dedicated solely to financing this business, so we have a business that understands these borrowers," Beacham said.

While any lender has risk, rental demand has gone nowhere but up. Tight credit on the buying side and rising mortgage rates have weakened affordability and kept more renters where they are. Potential first-time homebuyers have been sidelined by affordability issues as well as student loan debt, keeping them renters longer than they might have hoped.

For investors, that's cash in the bank, and for Blackstone, lending offers yet another opportunity.

"The lending into that community is a way to plant future buys that you're going to harvest," Barrack said.

—By CNBC's Diana Olick. Follow her on Twitter @Diana_Olick.

Questions?Comments? facebook.com/DianaOlickCNBC