Asian equity markets were mostly higher on Thursday with Japan's at fresh six-year highs but mainland shares fell on renewed worries about tight liquidity conditions.

Optimism over the global economic outlook underpinned gains following the release of upbeat U.S. economic data on Tuesday. Durable goods orders surged in November while a gauge of planned business spending on capital goods recorded its largest increase in nearly a year.

Markets in Australia, New Zealand and Hong Kong were closed for the Boxing Day holiday.

(Read more: )

Nikkei up 1%

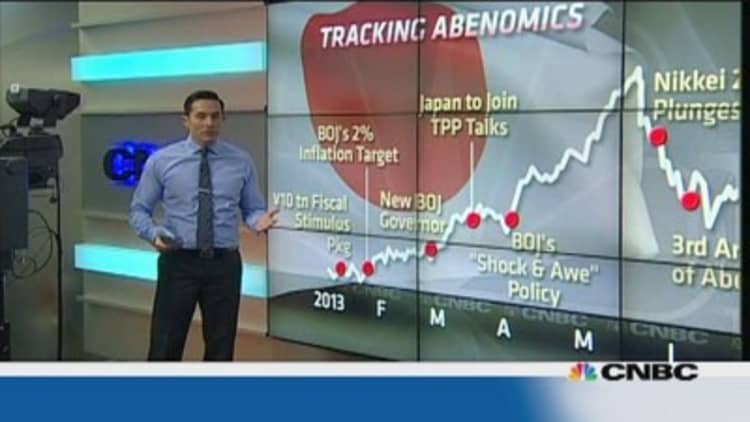

Japanese shares closed at their highest level in six years for a third session in the past seven days thanks to a weaker currency. The yen hit a new five-year low of 104.84 against the dollar, surpassing last week's peak of 104.64.

(Read more: Could dollar-yen hit 125 next year?)

Banks led the gains with Sumitomo Mitsui Financial, Miuzho and Mitsubushi UFJ up over 2 percent each.

Telecom firm Softbank rose 3.4 percent on news it is in talks from Deutsche Telekom. The deal is expected to be worth $20 billion and will be carried out through it's other recent American acquisition, Sprint.

Minutes from the Bank of Japan's November policy meeting showed members largely agreed that the nation's economic recovery was on track as an improving labor market lifted consumer spending.

Shanghai 1.5% lower

The mainland's benchmark Shanghai Composite widened losses after the People's Bank of China skipped Thursday's open market operations. The move came as the seven-day repurchase rate steadied around 5.3 percent after rising to six-month peaks last week.

(Read more: China short-term rates ease, fiscal deposits help)

Financials were among the most actively traded stocks. Pudong Development Bank lost as much as 2 percent while Minsheng Bank eased over 1 percent after a report showed bad loans in the wholesale and retail sector reached 2.6 percent, well above 2013's industry average.

Investors also reacted to news that economic growth is likely to come in at 7.6 percent this year, according to a cabinet report cited by the official Xinhua news agency, above the government's target of 7.5 percent.

(Read more: Retailers not theway to play China consumer growth: Pimco)

Kospi slips 0.1%

South Korean shares reversed gains to close just below the flat line after hitting their highest level in nearly a month earlier in the session.

A weaker yen sparked declines among major domestic exporters as it hurts their competitive advantage. Samsung Electronics, LG Display and Hyundai Motors slipped between 0.2 to 0.6 percent.

Emerging markets mixed

India's benchmark Sensex index was rangebound as traders awaited a report from the Reserve Bank of India at the end of the month, which is expected to unveil a major change in monetary policy.

(Watch now: Rajan: India's James Bond of banking)

Meanwhile, Thai shares shed as much as 1.2 percent after police fired teargas and rubber bullets at protesters in Bangkok following their attempt to disrupt election planning.

— By CNBC.com's Nyshka Chandran. Follow her on Twitter @NyshkaCNBC