(Click for video linked to a searchable transcript of this Mad Money segment)

released on Friday has triggered widespread concerns on Wall Street. With the report showing the economy created more than 100,000 fewer jobs than expected, investors can't help but wonder if a slowdown is imminent.

"The jobs report has changed the landscape," admitted Jim Cramer. And that makes the spate of earnings scheduled to be released next week all the more important. They will either confirm or deny the growing speculation that the economy may be running out of gas.

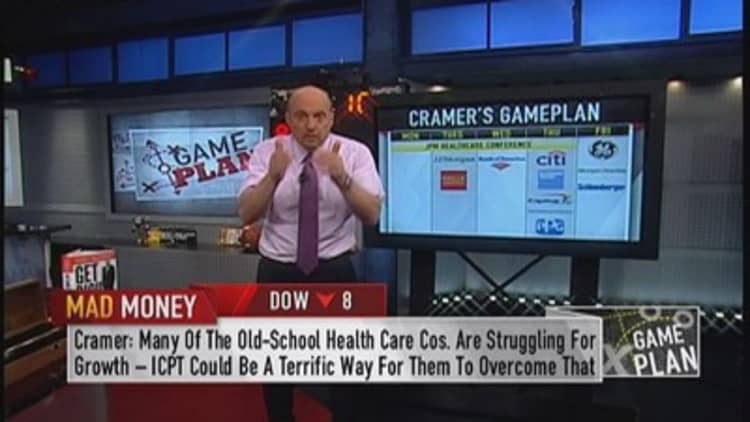

Watch should you be watching? Following are the earnings and other events that Jim Cramer thinks will matter most in the week ahead.

MONDAY JANUARY 13

On Monday, Cramer will be keeping an ear toward the JP Morgan Healthcare conference in San Francisco where hundreds of companies will be presenting new information about their most promising drugs.

Whether the economy slows or not Cramer is relatively confident that firms developing potentially lifesaving drugs should continue to go up.

"You know my four faves are Gilead, Celgene, Regeneron and Biogen," Cramer noted. However the Mad Money host will also be on the prowl for lesser known companies as well.

"Many investors hadn't heard of Intercept Pharma until quite recently, when a favorable result sent shares surging. Shares went from $60 to $460 in a matter of one week. Therefore I intend pay close attention to companies I have never heard of. Who wouldn't want a winner like that?"

TUESDAY JANUARY 14

On Tuesday, Cramer will be looking for further insights into the state of the economy when JP Morgan and Wells Fargo report their earnings.

"These two banks pretty much define the universe, with JPM being the quintessential investment house and Wells Fargo being a mortgage machine," Cramer said.

-----------------------------------------------------------------

Read More from Mad Money with Jim Cramer

-----------------------------------------------------------------

Looking at JPMorgan stock specifically, Cramer also wants to hear about lawsuits and settlements. "These days JPMorgan seems to go up on every settlement."

WEDNESDAY JANUARY 15

Again Cramer will be looking for economic insights from a bank, this time it's Bank of America.

Also a fan of BofA stock Cramer will be specifically listening for ways in which the company may return capital to shareholders. "I expect to hear something about how 2014 will be the year of the dividend and the buyback because the company's now brimming with cash."

THURSDAY JANUARY 16

Yet again, Cramer will be focused on banks, this time Citigroup and Goldman Sachs. Looking at the companies specifically, Cramer thinks both may be ready 'for some real breakout moves.'

Turning attention to another sector, UnitedHealth also releases quarterly results on Thursday. "I believe UNH will declare itself a winner in the new world of health care when it reports, and people will accept it with acclamation."

Also Cramer is eager to hear from PPG. "Now PPG is something special around here because it's run by Chuck Bunch, a CEO who has made our viewers money forever and I don't think Thursday will be any different."

FRIDAY JANUARY 17

On Friday, yet another bank as well as an industrial giant both land in the spotlight with earnings from Morgan Stanley and GE. "These could be terrific quarters for both and I expect outlooks to be raised after both earnings reports."

Also Cramer will parse through results from . "Here I am less certain what the company will have to say because oil's been coming down. However I'm much more interested in their outlook than their past quarter." What they about the year ahead may be prescient.

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com