Box, Dropbox. If these cloud companies go public this year, it's doubtful that they'll incite the same market hysteria that preceded the initial public offerings of social media darlings Facebook and Twitter.

After all, technology companies that let enterprises and individuals manipulate or store data in the cloud are much less sexy than social networking with friends. But they have a few important things in common with the social companies, according to tech experts: They compete in a niche with low entry barriers and attract a lot of free users who are difficult to convert to revenue generators.

"We've seen this movie before," said Morningstar equities analyst Rick Summer. "You have a lot of the excitement that coalesces around these [firms], and it dissipates really quickly. Companies like Box and Dropbox are solving real problems, but they're problems that aren't unsolvable by other companies."

Barb Darrow, a senior writer and cloud expert for Gigaom, a technology media firm, noted that both Dropbox and Box are mum on a key metric.

"You need to press them hard on paying customers versus the freeloaders," she said. "Dropbox has 200 million users, but how many of those pay? If I were an underwriter, I would hammer them on that. It's very hard to convert free to paid users."

Driven by the vast amount of media being consumed on computers, smartphones and tablets, the cloud storage capabilities of companies like Box are clearly creating enthusiasm for the cloud in the public market.

(Read more: Marissa Mayer's new plan for Yahoo)

Individuals and enterprises are requiring "an immense amount of storage," said Anand Sanwal, CEO and co-founder of CB Insights, a firm that tracks investment, M&A and IPO activity. "There's no point to buying 50 hard drives to house it—people are warming to the idea of having all this storage in the cloud. It's riding a wave that is going to be around for a while."

As part of a fastest-growing tech sector, one of the handful of cloud-based companies could well be the bellwether IPO of 2014.

"The IPO market is pretty dependent on what was going on in the quarter prior—we expect cloud to be well-received by investors," said Summer at Morningstar.

Though analysts say the sector is big enough for Box, Dropbox and the dozen or so competitors (including Accellion and AeroFS) to capture a significant share of the market, investors should be careful about investing in the bellwether IPOs. The hype could lead to overvalution when it comes to IPO pricing.

"The way people work today is changing," Box said in an email statement. "They want to be able to share with partners and customers, and they want simple, intuitive experiences that are easy to use. ... It's a big reason why we've grown to have more than 25 million users. At the same time ... we've also built a solution that satisfies the security requirements of today's IT department, which is why we have more than 200,000 businesses and 99 percent of Fortune 500 companies using Box today, including companies like Procter & Gamble, Nationwide Insurance and Electronic Arts."

Dropbox declined to comment.

According to IPO investment advisor Renaissance Capital, 12 cloud-based companies went public last year, accounting for about a fourth of all tech IPOs in 2013. As a group, the cloud companies posted an average return of 50.6 percent from their IPO price, boosted by a 211 percent return from cloud marketing software firm Marketo and a 148 percent return from Benefitfocus, a cloud-based platform for employee benefits management.

Tech research firm Gartner expects the cloud market to grow to $183 billion by 2015, up from $112 billion in 2012; IHS Technology projects that it will reach $235 billion by 2017.

(Read more: Top hedge funds clings to eBay, Apple)

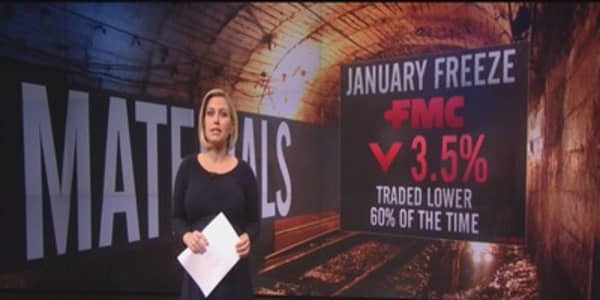

With few exceptions, cloud company returns look good so far in 2014, according to Renaissance data. Its IPO ETF, a basket of newly public companies, is up 3.5 percent this year and is outpacing the return of the S&P 500.

"That's thanks to strong return from growth companies, including holdings in cloud-based HR platform Workday and IT platform ServiceNow," said Kathleen Smith, principal at Renaissance Capital.

Low level clouds

Names like Workday and ServiceNow may not attract the most attention, but they resemble some of the cloud firms that may look to go public in one important respect: They can lay out lucid metrics, including attractive profitability road maps, to potential investors.

Most won't ever be hot household names—they target enterprises, not consumers—but the public market is increasingly aware of the investment allure of the cloud: software as a service (SaaS), in which cloud providers help lower clients' IT costs by hosting their software and data.

As more businesses continue to move their IT services, applications and infrastructure to cloud-based solutions, global spending is expected to surge.

"How they're going to make money is clear," said Sanwal at CB Insights. "Before they go public, [these firms] have been generating revenue and there is less of that uncertainty that leads to more of the swings on the consumer side of things. They're a little less volatile."

(Read more: Spotify job posting leads to IPO speculation)

According to Bryan McLaughlin, a deals partner at PwC, cloud companies in the SaaS category (think younger versions of Salesforce.com, the granddaddy of cloud applications firms) could be among the year's most solid investments because they possess two distinct characteristics.

"The IPO market yearns for two things in a profile of a successful candidate: growth, which drives valuation of the business, and predictability, which mitigates downsize risk for the investor," he said.

Most SaaS companies charge either a licensing or a subscription fee to use their service for a certain amount of time, benchmarks that make revenue growth readily apparent for investors.

"It's not about upselling your existing customer base—it's about how do you expand that base," McLaughlin said.

A number of SaaS companies are in Renaissance Capital's IPO pipeline, including Amber Road (global trade management), Q2 Holdings (banking services), Paylocity (payroll) and Globoforce (human capital management).

But the Renaissance's shadow backlog contains storage firms Dropbox and Box. The latter recently closed a $100 million round of venture capital funding and reportedly filed its IPO paperwork earlier this year. (Dropbox, with 200 million users, reportedly holds a valuation of $10 billion.)

An integration option

Analysts point to another segment in the cloud with the potential to turn out lucrative IPOs: Middleware, or companies (such as MuleSoft and WS02) that provide services that combine entities' disparate programs.

"It's about flexibility," said Summer, noting that cloud-based middleware hasn't seen the investment that SaaS and storage have.

"When you have a complicated IT infrastructure with not just one application but 50, some of which may be custom built and they all have to talk with each other—how do you optimize that?" he said.

One thing is for sure: If the pace of companies filing IPO paperwork keeps up, the U.S. IPO market is set to soar this year.

According to Renaissance Capital, 35 firms have already priced in 2014, up 75 percent year over year—the best annual start since the mid 2000s.

Software, which encompasses cloud firms, is expected to do well even at the pre-IPO venture capital stage.

"The software category, with the exceptions of a few bumps, has led the way in terms of funding," said McLaughlin at PwC. "And we're definitely looking for this same trend in 2014."

In a more fundamental way, the cloud will propel the IPO market in coming years, even when its own companies aren't the ones conducting offerings. Cloud computing has affected how startups across many sectors operate: New companies can rent infrastructure from companies like Amazon rather than having to build from scratch. Venky Ganesan, a managing director at Menlo Ventures in Menlo Park, California, said, "We're seeing companies growing faster than at any time in history." That means startups can be ready sooner to go public or be acquired.

—By Maggie Overfelt, Special to CNBC.com, additional reporting by Joel Dreyfuss