Adobe Systems, the maker of Photoshop and Acrobat software, forecast current-quarter profit and revenue above analysts' estimates, citing strong demand for its Creative Cloud suite and digital marketing software.

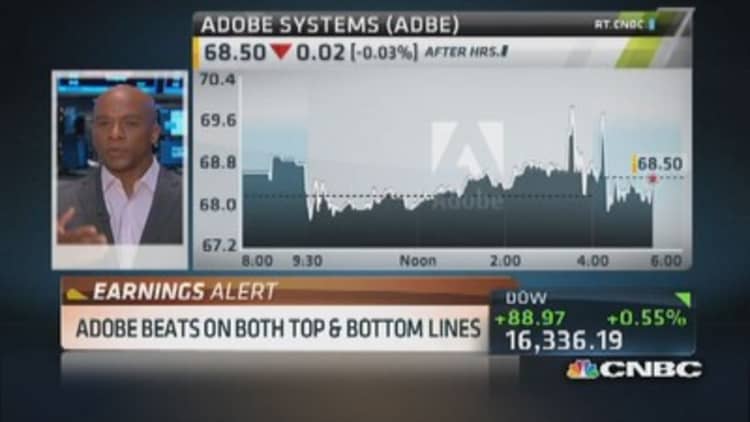

Shares of the company, which also posted better-than-expected results for the first quarter ended Feb. 28, rose 1 percent in extended trading.

The company net added 405,000 paid users for its Creative Cloud suite, which includes Photoshop, Illustrator and Flash software, taking its total user base to 1.84 million as of Feb. 28.

"We are making good progress migrating individual, team and enterprise customers to Creative Cloud ... retention and renewal rates after promotions expire continue to track ahead of our internal projections," Chief Executive Shantanu Narayen said on a conference call with analysts.

(Read more: Oracle quarterly results miss forecasts; shares drop)

R.W. Baird analyst Steve Ashley said Adobe's results were "solid through and through" and the company's user additions and annualized recurring revenue (ARR) were better than expected.

Macquarie Securities analyst Brad Zelnick said the results showed that Adobe's subscription-based growth strategy was working.

Adobe said it would soon phase out the traditional box license versions of its Creative Suite 6 and offer the software only on a web-based subscription model.

Subscription models bring in less money upfront, but they usually ensure more predictable recurring revenue.

Revenue from the company's digital marketing software unit rose 17 percent in the first quarter as revenue from Adobe Marketing Cloud software rose by about a quarter.

(Watch: Analyzing Oracle's Q3 earnings)

The company offers Creative Cloud and document services under its digital media unit, while its digital marketing unit offers marketing analytics tools, document management and web conferencing software.

Adobe said ARR from Creative Cloud rose to $987 million in the quarter from $237 million a year earlier.

The company said this was the first time that it received more than half of its total revenue from recurring sources such as Creative Cloud subscriptions and digital marketing software.

Adobe counts General Motors, Walt Disney, and Electronic Arts as customers, and its Adobe Primetime software was used by NBC Sports to stream Sochi Olympics coverage to desktops and other mobile devices.

Results, forecast

Adobe forecast adjusted profit of 26-32 cents per share and revenue of $1 billion-$1.05 billion for the second quarter ending May 31.

Analysts on average were expecting a profit of 26 cents per share on revenue of $990.4 million, according to Thomson Reuters I/B/E/S.

Adobe said it expected to meet or exceed its 2014 earnings and revenue forecast.

Net income fell to $47 million, or 9 cents per share, in the first quarter from $65.1 million, or 13 cents per share, a year earlier.

Excluding items, the company earned 30 cents per share. Analyst on average had expected 25 cents per share.

Revenue fell about 1 percent to $1 billion, but came above the average analyst estimate of $973.1 million.

The results were inadvertently released on Adobe's website ahead of the expected announcement after the bell on Tuesday and confirmed by the company later.

Adobe's shares closed 0.5 percent higher at $68.52 on the Nasdaq on Tuesday. The stock has gained about 20 percent in the three months to Tuesday's close.

—By Reuters