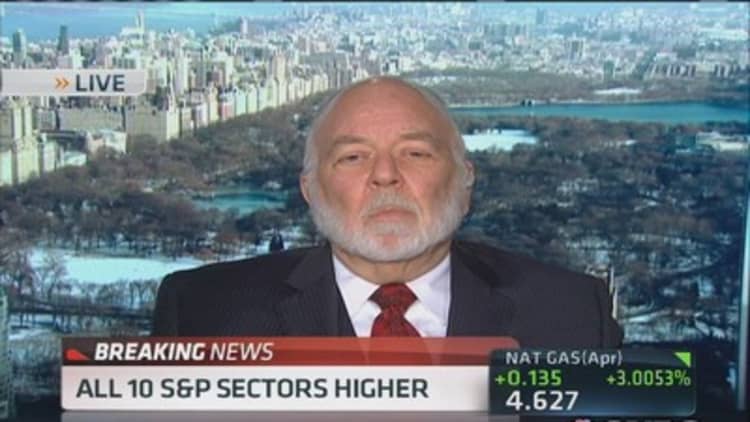

Citigroup stock was a "sell" following the Federal Reserve's rejection of its capital plan, noted bank analyst Dick Bove said Wednesday on CNBC.

"The situation in Mexico is, in my view, a horror show because basically, at this stage, seven years after the big crisis which almost—which did make them bankrupt—this company finds that it doesn't have controls in Mexico and lets $400 million walk out the door," he said. "This company is not a 'buy.' I don't care what the price to tangible book is. It is not a 'buy.' "

Earlier this month, the U.S. Securities and Exchange Commission was reportedly found to be investigating Citigroup for accounting fraud after it had disclosed $400 million in bad loans in its Banamex unit.

Read MoreSEC investigating Citigroup over Mexico fraud: Source

On "Fast Money," Bove of Rafferty Capital Markets said that he continued to view Morgan Stanley and Bank of America favorably.

"These banks are in terrific condition," he said. "So, I think their earnings will go up. Their stocks are still selling at pretty close to book, so I think they're pretty good stocks."

Bove does not hold stakes in the banks mentioned.

Read MoreDick Bove bullish on bank stocks after stress tests

Other traders were not sold on Bove's rationale.

Tim Seymour of EmergingMoney.com was still a believer in Citigroup.

"I love the global franchise. I do think that they had issues in Banamex," he said. "I do think that this is a story that people need to wonder why they still are under the thumb. I think they're being made examples of. That would be what worries me."

Seymour said that he was Bank of America was interesting following a review by the Federal Reserve.

Karen Finerman of Metropolitan Capital Advisors, who is long Citigroup call spreads, said that she was still bullish.

Read MoreFannie Mae and Freddie Mac must not die: Dick Bove

"I think that it is by far the cheapest. They will get it together. Admittedly, it's taken much longer," she said. "I've got to push back on Dick Bove. He was right. He had a 'sell.' But it looked to me like they had a $49.60 target. That's where it was yesterday. I do still think this is a premier franchise and worth owning."

Stuart Frankel's Steve Grasso said that Bank of America was still a compelling stock from a technical standpoint.

"It might back up a little bit with the group, but I think ultimately you're looking at low-$20s to mid-$20s," he said.