(Click for video linked to a searchable transcript of this Mad Money segment)

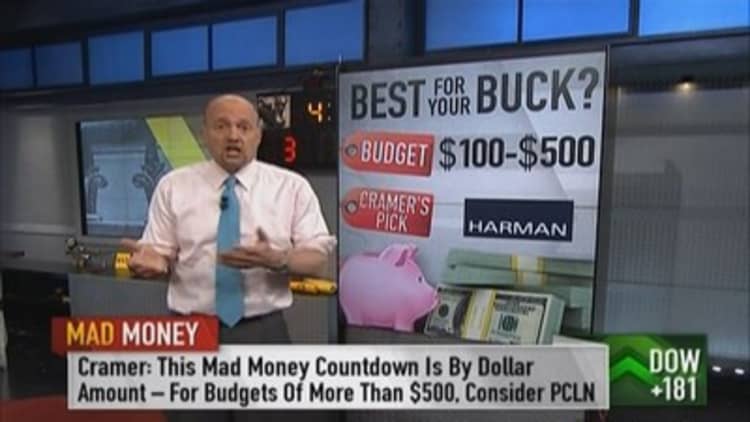

Although a stock's price has nothing to do with whether a company is ultimately worth owning, Jim Cramer knows many individual investors have limited capital and must therefore think about the total cost of buying 100 shares or more.

Therefore, he's identified a stock that currently trades between $50-$100, that he likes a lot.

"I've got a clear favorite in this range. It's," Cramer said.

Largely Cramer thinks the stock is cheap given the growth opportunity.

"While the big three airlines are looking for ways to make their passengers pay more, has achieved business success by charging the lowest fare possible," Cramer explained.

And in an era when travelers have become extremely cost conscious, Spirit's pricing strategy has been embraced with great enthusiasm.

"Spirit has made a bet that cost-conscious consumers simply want to find the cheapest way to fly, and that bet has paid off in a big way," Cramer said.

Business is booming. And Cramer says Spirit is handling that business with great efficiency.

"The company has 55 planes at the moment, but they use those planes more efficiently than the competition, keeping them in the air for 13 hours a day, whereas a Jet Blue only flies its planes for 12 hours a day, and at Southwest that number is less than 11 hours. Also, the company outfits its planes with more seats than the competition, too. On a Spirit Airbus A320 there are 178 seats, versus just 150 seats for Jet Blue on the same model of airplane. True, there's less legroom on a Spirit Airlines flight, however, the revenue potential per flight is greater."

And as efficient as Spirit has been at running their business, Cramer says it's equally important that they're growing their business, too.

"Right now Spirit has just 55 aircraft serving 125 non-stop markets, but the company is growing its fleet aggressively, which means this is an airline with an enormous runway for future growth." Cramer said. (Pun intended)

"You see, at the moment the company controls just 1.4% of the U.S. market. But Spirit's management believes that by 2021, seven years from now, they'll have 140 planes and will control 5% market share in this country."

Cramer doesn't think that's priced in.

"Despite the stock's advance, it remains really inexpensive, selling for only 15.75 times next year's earnings, cheaper than the average stock in the S&P 500, even though Spirit has a fabulous 25% long-term growth rate."

----------------------------------------------------------------

Read more from Mad Money with Jim Cramer

Distorted relationships trigger declines

Cramer's strategic timing buy

Cramer: Alcoa has reinvented itself

----------------------------------------------------------------

All told, Cramer is a buyer.

"If the company can execute on this plan, and I believe it can, then its stock could, well, take off," Cramer said. (pun intended)

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com