A stock's dollar amount doesn't say all that much about a stock. Jim Cramer would prefer you ignore it all together as you make your investment decisions.

However, he knows that you can't.

The "Mad Money" host knows most of you have limited amounts of capital at your disposal, and must therefore consider share price, and the resulting cost of buying a block of stock, as you put money to work.

Because Cramer believes shares of quality companies are the best way to invest for the future, he's put together a list of favorite stocks at different price points.

Therefore, whether you're rich as Midas, poor as a pauper or somewhere in between, you should find that at least one stock from the list below that fits your wallet, no matter how petite or overstuffed it may be.

Over $500: Priceline

Of the 5 stocks mentioned here, Priceline is, by far, the most expensive in terms of total capital needed to establish a position. Buying a block of 100 shares would cost you well over $100,000.

Ironically, Cramer says from the Street's perspective, the stock is actually cheap.

When he profiled Priceline on April 7th, he said "On a price-to-earnings multiple, Priceline is actually the cheapest of the high growth stocks that I follow. Priceline trades at a forward P/E of about 19 on 19% earnings per share growth. That's barely more than the average stock."

Yet compared to the average stock, Cramer said the growth potential was significantly greater.

First, Cramer said Priceline was well positioned to capture new business as corporate travelers both in the US and abroad turned to the web in a quest to cut travel costs. Second, he liked that Priceline had a strong presence overseas where the migration to online travel was in earlier stages. Third, Cramer said, "Priceline's incredibly strong acquisition of Kayak in 2012 for $1.8 billion promised to become a game changer with referrals generating a huge amount of business."

All told, if you can afford the cost of establishing a position in Priceline, Cramer thinks you're getting a big bargain. But move strategically. Since making the recommendation shares of Priceline have surged 5%.

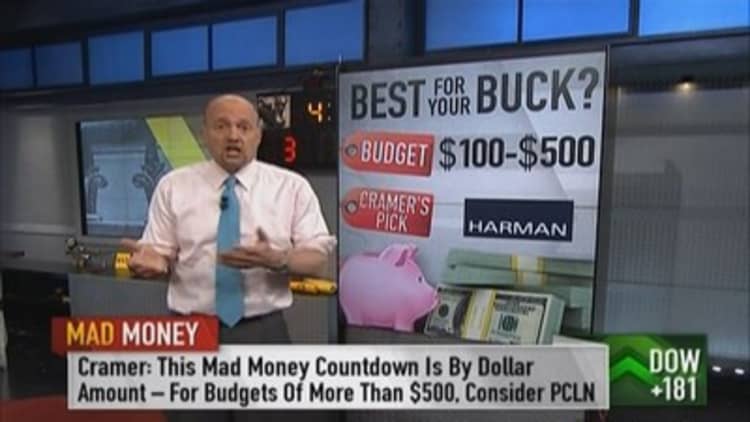

Between $100 - $500: Harman

In this price range, Cramer thinks Harman, a maker of audio equipment, presents significant opportunity, due to its aggressive position in the auto industry.

"Harman makes dashboard interface systems that integrate everything from navigation and safety to media and smartphone connectivity, all of which are bundled together into what's known as an infotainment system," explained Cramer on April 8th.

Although Harman systems are already used by nine of the world's fifteen largest auto-makers, "I can see demand spreading," Cramer said.

Here's just one reason why. "Apple just rolled out their CarPlay system, which lets you synch up your iPhone to your car's built-in display, a much safer way to use your smartphone while you drive. But the thing is, CarPlay requires an embedded infotainment system in order to work, which, in turn, should boost demand for Harman's technology."

Between $50-$100: Spirit Airlines

"I've got a clear favorite in this range. It's Spirit Airlines," Cramer said. Although Cramer is bullish on airlines broadly due to recent consolidation, on April 9th, he said the business model of Spirit sets it apart from all others.

"Spirit has made a bet that cost-conscious consumers simply want to find the cheapest way to fly, and that bet has paid off in a big way," Cramer said.

Business is booming. And Cramer says Spirit is handling that business with great efficiency. And, largely, the opportunity hasn't been priced in.

"Despite the stock's advance over the past 3 months, it remains really inexpensive, selling for only 15.75 times next year's earnings, cheaper than the average stock in the S&P 500, even though Spirit has a fabulous 25% long-term growth rate."

Between $10 - $50: GT Advanced Technologies

If you don't want to spend more than $50/share, on April 10th, Cramer said there were two big reasons to put GT Advanced Technologies on your radar.

First, Cramer said the stock was a play on the tech industry's growing interest in sapphire, one of the hardest substances on earth, with both Apple and Samsung using more sapphire-based innovations in their gadgets.

Second, "Apple loaned GT Advanced Technologies $578 million to build a big synthetic sapphire plant in Arizona that will be able to directly supply the iPhone maker with sapphire for years to come," Cramer said.

The development triggered speculation that "Apple might change the material they use to make the touchscreen on the iPhone," Cramer said. "Right now Apple is using a hard glass made by Corning. The trouble with glass, though, is that it breaks. If Apple were to switch to sapphire, the thinking goes, they'd have a product with an unbreakable touchscreen."

Taking that theoretical scenario one step further, "If Apple were to make that switch, it would be a gigantic positive for GTAT and the stock should roar." Cramer said.

Of course, that kind of bet is purely speculative; therefore Cramer can only advocate a position in GT Advanced technologies as a spec play.

Under $10: Rite-Aid

If cash is tight but you want to invest in stocks, on April 11th, Cramer said Rite-Aid might be just what the doctored ordered.

He believes the company and therefore shares are facing a slew of tailwinds including an aging population, more customers due to Obamacare, and drugs going off patent.

Of course, those catalysts benefit all drug stores, not just Rite Aid. However, there are additional catalysts that Cramer sees that are specific to this company.

A. Rite-Aid has implemented an aggressive remodeling program. In the last three years, Rite-Aid has converted 1,200 of its 4,600 stores, more than a quarter, to their new format. "The new format delivers front-end same store sales that are 300 basis points higher than the non-remodeled locations," Cramer said.

----------------------------------------------------------

Read more from Mad Money with Jim Cramer

Market ignoring flood of positives

Value quest: Is Coke the real thing?

Hated stock to generate lovely returns?

----------------------------------------------------------

B. Rite-Aid has aggressively shut down underperforming stores to focus on profitability.

C. Rite Aid has 25 million loyalty card members, and over the past year, Rite-Aid has been using information collected from those costumers to bring a new level of sophistication to their targeted marketing campaigns. "Ultimately, that creates more traffic and customers buying more merchandise on each visit," Cramer said.

All told, Cramer sees every reason for shares to rally and with the stock currently around $7, a new position won't set you back much more than 100 bottles of vitamins.

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com