U.S. stock index futures traded lower on Monday, following the first back-to-back weekly losses since January for the S&P 500, weighed by individual stock news and macroeconomic and geopolitical concerns.

Investors have flocked to "safe haven" assets like U.S.Treasury bonds, and out of stocks, on concerns including when the Federal Reserve might start raising interest rates, whether the European Central Bank will announce further monetary stimulus, and the turmoil in Ukraine.

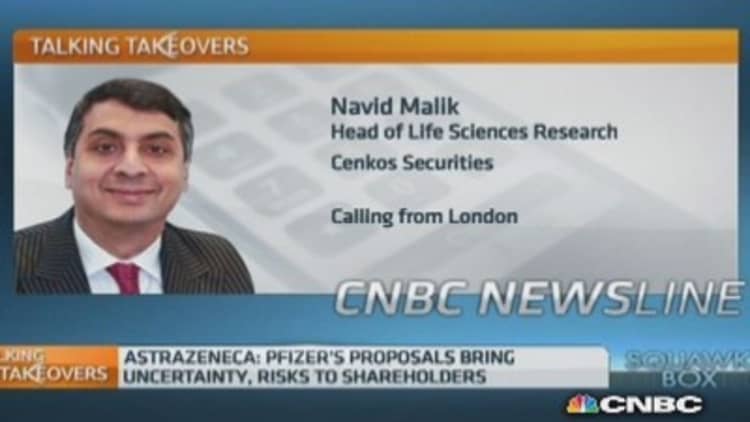

Merger and acquisition news remained in focus. Pfizer climbed after U.K. rival AstraZeneca rejected a sweetened takeover bid. Shares of AstraZeneca tumbled nearly 10 percent in pre-market trading.

Meanwhile, shares of AT&T slumped after the telecom company launched a $48.5 billion for satellite TV operator DirecTV on Sunday. The deal comes as Comcast awaits regulatory approval of its $45 billion bid for Time Warner Cable. Comcast is the parent company of CNBC.

Read MoreHere's why we'regetting together: AT&T, DirecTV

General Electric traded flat despite reports that Germany's Siemens could make a rival bid for Alstom's power business as early as this week. General Electric has already submitted a 12.35 billion euro ($16.9 billion) bid, but Alstom has opened its books to Siemens sunder strong political pressure from the French government.

Campbell Soup dropped sharply after the canned soup maker reported weaker-than-expected quarterly sales and lowered its full-year revenue growth forecast.

Apparel retailer Urban Outfitters is scheduled to post earnings after the closing bell.

Home Depot, TJX, Lowe's, Target and Hewlett-Packard are among notable earnings slated to post results throughout the week. (Click here for CNBC's full earnings coverage)

No major economic reports are due Monday.

San Francisco Fed President John Williams and Dallas Fed President Richard Fisher are scheduled to speak in a panel discussion in Dallas later this afternoon.

Read MoreBusting 3 bigage-based investing myths

On tap this week:

Monday: Fed's Fisher speaks

TUESDAY: Fed's Plosser speaks, Fed's Dudley speaks, Microsoft Surface event; Earnings from Home Depot, Dick's Sporting Goods, Staples, TJX

WEDNESDAY: Mortgage applications, Fed's Dudley speaks, Fed's Yellen speaks, oil inventories, Fed's George speaks, Fed's Kocherlakota speaks, FOMC minutes, Boeing investor conference; Earnings from Lowe's, Target, Hormel, PetSmart, Tiffany, American Eagle Outfitters, L Brands, NetApp, Williams-Sonoma

THURSDAY: Jobless claims, Chicago Fed nat'l activity index, PMI mfg index flash, existing home sales, leading indicators, Kansas City Fed mfg index, Fed's Williams speaks, Facebook annual mtg, Intel shareholder mtg; Earnings from Best Buy, Dollar Tree, Hewlett-Packard, Gap, Marvel Tech, Ross Stores, Aeropostale, Gamestop, TiVo

FRIDAY: New home sales; Earnings from Foot Locker