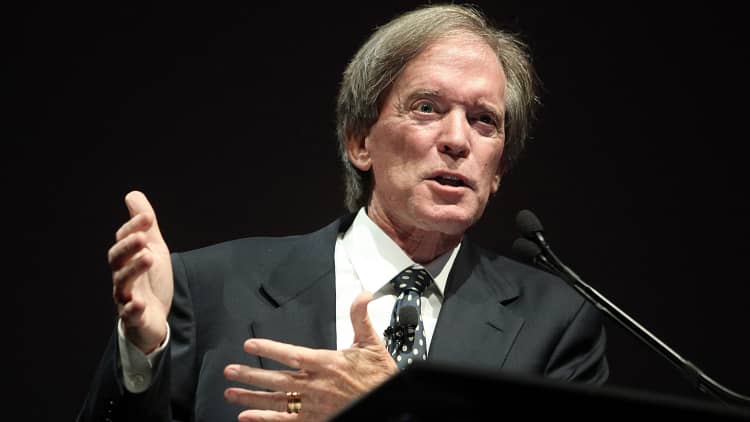

Pimco founder and CIO, Bill Gross said he sees bubbly pockets in the market.

"There's bubbly aspects in terms of the terms and conditions, for instance, in terms of bank loans. There can be tight conditions which restrict a company in terms of their ability to lever going forward," Gross said in an interview on CNBC Wednesday.

"...There can be easy types of covenants and restrictions and certainly the Fed see's, and we see as well, that over the past 12 to 18 months that those standards have been eased and perhaps are a little bit bubbly," he explained.

In terms of spreads themselves and the prices of risk assets, Gross said he sees them on a "normal level if the new neutral stays low at 2 percent."

Pimco Total Return fund posted $4.5 billion in net outflows for June, logging its 14th straight month of investor withdrawals despite an improving performance, according to data from Morningstar data.

Read MorePimco flagship fund is still bleeding billions

The fund has had $64.1 billion in outflows since May 2013, the data showed. It had $225 billion in assets at the end of last month, down from a peak of $292.9 billion in April 2013.

The record outflow streak continued despite the fund's 0.37 percent gain in June, which beat 88 percent of peers, according to Morningstar. That said, the fund is up 3.70 percent for the year and is trailing 71 percent of its peers.

—By CNBC.com. Reuters contributed to this report.